Question: Answer both questions. Full marks are indicated by the side of each question. To answer a question, you can create additional space in the editable

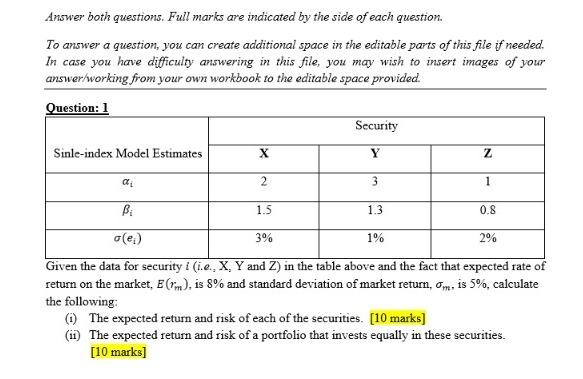

Answer both questions. Full marks are indicated by the side of each question. To answer a question, you can create additional space in the editable parts of this file if needed. In case you have difficulty answering in this file, you may wish to insert images of your answer/working from your own workbook to the editable space provided. Given the data for security i (i.e, X,Y and Z ) in the table above and the fact that expected rate of return on the market, E(rm), is 8% and standard deviation of market return, m, is 5%, calculate the following: (i) The expected return and risk of each of the securities. [10 marks] (ii) The expected return and risk of a portfolio that invests equally in these securities. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts