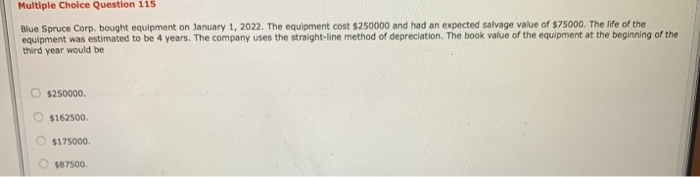

Question: answer both questions Multiple Choice Question 115 Blue Spruce Corp. bought equipment on January 1, 2022. The equipment cost $250000 and had an expected salvage

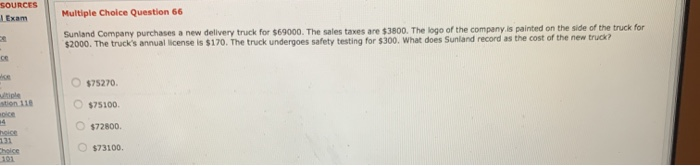

Multiple Choice Question 115 Blue Spruce Corp. bought equipment on January 1, 2022. The equipment cost $250000 and had an expected salvage value of $75000. The life of the equipment was estimated to be 4 years. The company uses the straight-line method of depreciation. The book value of the equipment at the beginning of the third year would be $250000 $162500 $175000 $87500 Multiple Choice Question 66 Sunland Company purchases a new delivery truck for $69000. The sales taxes are $3800. The logo of the company is painted on the side of the truck for $2000. The truck's annual license is $170. The truck undergoes safety testing for $300. What does Sunland record as the cost of the new truck? $75270 $75100 $72800 $73100 hoice 101

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts