Question: Answer both questions please. 3. A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Year 0 1

Answer both questions please.

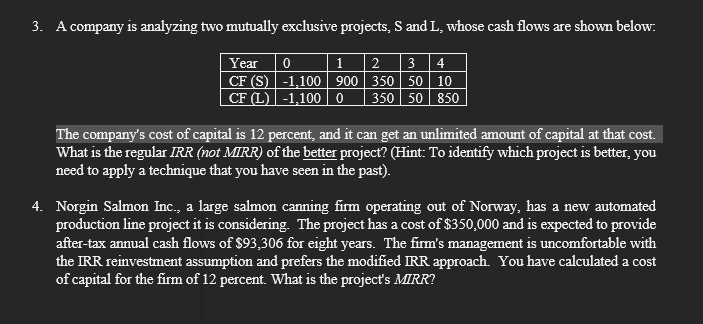

3. A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: Year 0 1 2 3 4 CF (S) -1,100 900 350 50 10 CF (L) -1,1000 350 50 850 The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. What is the regular IRR (not MRR) of the better project? (Hint: To identify which project is better, you need to apply a technique that you have seen in the past). 4. Norgin Salmon Inc., a large salmon canning firm operating out of Norway, has a new automated production line project it is considering. The project has a cost of $350,000 and is expected to provide after-tax annual cash flows of $93,306 for eight years. The firm's management is uncomfortable with the IRR reinvestment assumption and prefers the modified IRR approach. You have calculated a cost of capital for the firm of 12 percent. What is the project's MRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts