Question: answer both questions please!!!!! Edwards Electronics recently reported $11,250 of sales, S5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had

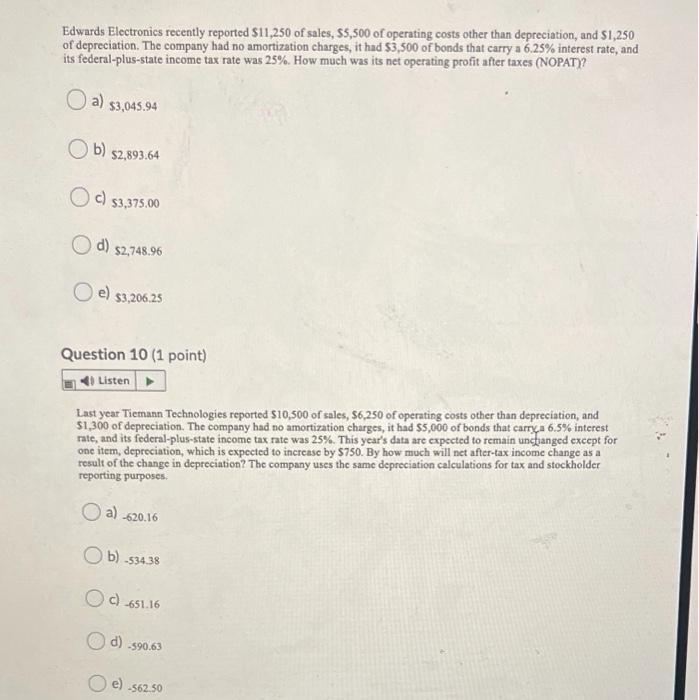

Edwards Electronics recently reported $11,250 of sales, S5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. How much was its net operating profit after taxes (NOPAT)? a) $3,045.94 b) $2,893.64 c) $3,375.00 Od) $2,748.96 Oe) $3,206,25 Question 10 (1 point) Listen Last year Tiemann Technologies reported 510,500 of sales, S6,250 of operating costs other than depreciation, and $1,300 of depreciation. The company had no amortization charges, it had $5,000 of bonds that carry a 6.5% interest rate, and its federal-plus-state income tax rate was 25%. This year's data are expected to remain uncJianged except for one item depreciation, which is expected to increase by 5750. By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes. a) -620.16 b) -534.38 Oc) -651.16 d) -590.63 -562.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts