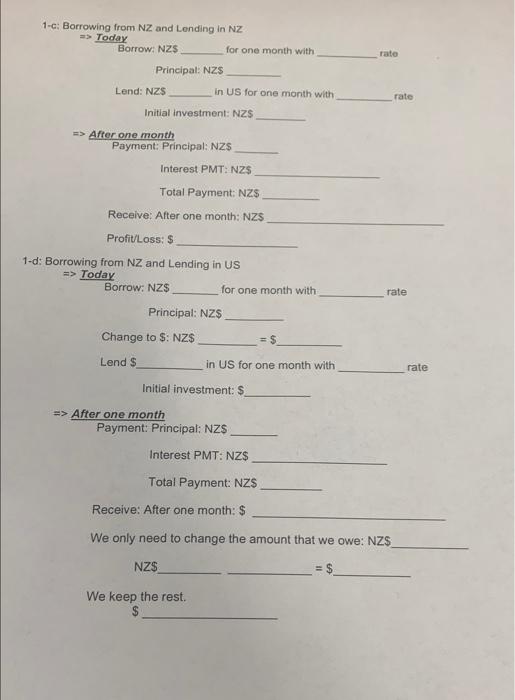

Question: answer both questions please Tato 1-c: Borrowing from NZ and Lending in NZ => Today Borrow: NZS for one month with Principal: NZS Lend: NZS

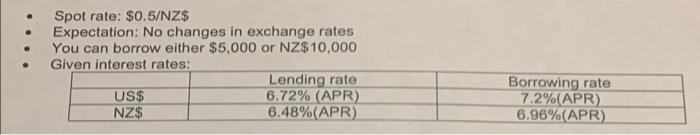

Tato 1-c: Borrowing from NZ and Lending in NZ => Today Borrow: NZS for one month with Principal: NZS Lend: NZS in US for one month with Initial investment: NZS => After one month Payment: Principal: NZS rate Interest PMT: NZS Total Payment: NZ$ Receive: After one month: NZS Profit/Loss: $ 1-d: Borrowing from NZ and Lending in US => Today Borrow: NZS for one month with rate Principal: NZ$ Change to $: NZ$ Lend $ in US for one month with rate Initial investment: $ => After one month Payment: Principal: NZS Interest PMT: NZ$ Total Payment: NZS Receive: After one month: $ We only need to change the amount that we owe: NZ$ NZ$ We keep the rest Spot rate: $0.5/NZ$ Expectation: No changes in exchange rates You can borrow either $5,000 or NZ$10,000 Given interest rates: Lending rate US$ 6.72% (APR) NZ$ 6.48%(APR). Borrowing rate 7.2%(APR) 6.96%(APR) Tato 1-c: Borrowing from NZ and Lending in NZ => Today Borrow: NZS for one month with Principal: NZS Lend: NZS in US for one month with Initial investment: NZS => After one month Payment: Principal: NZS rate Interest PMT: NZS Total Payment: NZ$ Receive: After one month: NZS Profit/Loss: $ 1-d: Borrowing from NZ and Lending in US => Today Borrow: NZS for one month with rate Principal: NZ$ Change to $: NZ$ Lend $ in US for one month with rate Initial investment: $ => After one month Payment: Principal: NZS Interest PMT: NZ$ Total Payment: NZS Receive: After one month: $ We only need to change the amount that we owe: NZ$ NZ$ We keep the rest Spot rate: $0.5/NZ$ Expectation: No changes in exchange rates You can borrow either $5,000 or NZ$10,000 Given interest rates: Lending rate US$ 6.72% (APR) NZ$ 6.48%(APR). Borrowing rate 7.2%(APR) 6.96%(APR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts