Question: answer both thanks! thumbs up if correct Amazon Inc. shares currently sell for 1,885 per share, the company pays no dividend. The 3-month American put

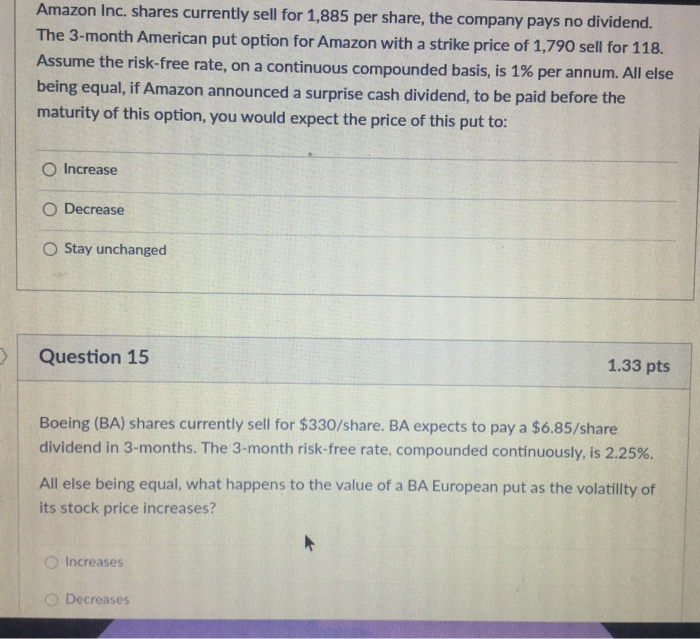

Amazon Inc. shares currently sell for 1,885 per share, the company pays no dividend. The 3-month American put option for Amazon with a strike price of 1,790 sell for 118. Assume the risk-free rate, on a continuous compounded basis, is 1% per annum. All else being equal, if Amazon announced a surprise cash dividend, to be paid before the maturity of this option, you would expect the price of this put to: O Increase O Decrease Stay unchanged > Question 15 1.33 pts Boeing (BA) shares currently sell for $330/share. BA expects to pay a $6.85/share dividend in 3-months. The 3-month risk-free rate, compounded continuously, is 2.25%. All else being equal, what happens to the value of a BA European put as the volatility of its stock price increases? Increases Decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts