Question: Answer Both You are evaluating two different silicon wafer milling machines. The Techron I costs $270,000, has a 3-year life, and has pretax operating costs

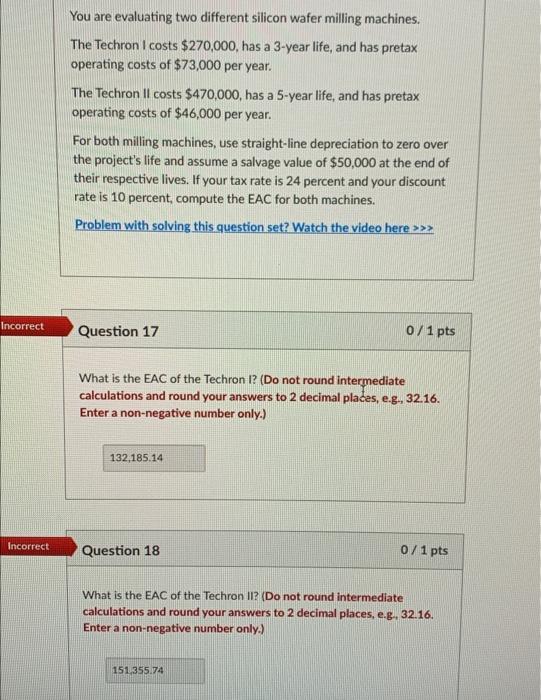

You are evaluating two different silicon wafer milling machines. The Techron I costs $270,000, has a 3-year life, and has pretax operating costs of $73,000 per year. The Techron Il costs $470,000, has a 5-year life, and has pretax operating costs of $46,000 per year. For both milling machines, use straight-line depreciation to zero over the project's life and assume a salvage value of $50,000 at the end of their respective lives. If your tax rate is 24 percent and your discount rate is 10 percent, compute the EAC for both machines. Problem with solving this question set? Watch the video here >>> Incorrect Question 17 0/1 pts What is the EAC of the Techron 1? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter a non-negative number only.) 132,185.14 Incorrect Question 18 0/1 pts What is the EAC of the Techron 11? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g. 32.16. Enter a non-negative number only.) 151355.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts