Question: Answer by using the most recent information found as of today on www.sec.gov Mini Case COST OF CAPITAL FOR SWAN MOTORS You une ty teen

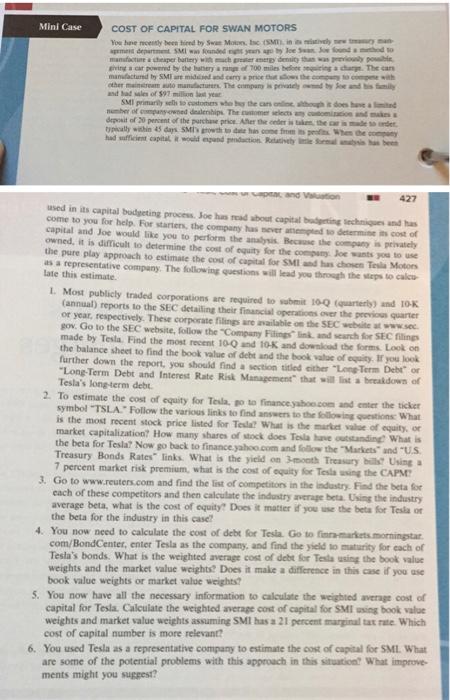

Mini Case COST OF CAPITAL FOR SWAN MOTORS You une ty teen by Swee Moon M. de SM w founded by Joe Sundhed to manufacture chaper battery with sucher mitha was rely po i acar powered by the lanery mag of 700 miles being a car. The can manufactured by SME re midday preth the com other to manufacturer. The company by sendin dat les of 97 milyar SMI primarily who customers who was the chose a la number of ownedenis. The customer Section deposit of 30 percent of the purchase price her the one is the under tally within 15 days SMS des comowes het and on 427 used in its capital boditing process. Joe has about capital big chinhas come to you for help. For starters, the company las nove ind denne cost of capital and Joe would like you to perform the analysis Become the company is privacy owned, it is difficult to determine the cost of equity for the colorants you to use the pure play approach to estimate the cost of capital for SM has chosen Tesla Motors as a representative company. The following questions will lead you through the eps to calice late this estimate 1. Most publicly traded corporations are required to 100 quarters and 10K (annual reports to the SEC detailing their financial operations are the previous quarter or year, respectively. These corporate filings are wailable on the SEC www. pov. Go to the SEC website, follow the "Company Finland such for SEC filing made by Testa Find the most recent 100 und 10-K and download the fores. Look on the balance sheet to find the book value of debt and the book value of equity. If you look further down the report, you should find a section titled either "Lone Term Debt" or "Long-Term Debt and Interest Rate Risk Management that will lista breakdown of Tesla's long-term debt. 2. To estimate the cost of equity for Tesla o te finance.yahoo.com and enter the ticket symbol "TSLA" Follow the various links to find answers to the following questions What is the most recent stock price listed for Tesla? What is the market value of equity, or market capitalization? How many shares of stock does Teslaan outstanding What is the beta for Tesla? Now go back to finance.yahoo.com and follow the Markets und "US Treasury Bonds Rates links. What is the yield on mooth Treasury Using a 7 percent market risk premium, what is the cost of equity for Testing the CAPM? 3. Go to www.reuters.com and find the list of competitors in the industry. Find the beta for cach of these competitors and then calculate the industry average beta. Using the industry average beta, what is the cost of equity? Does it matter if you use the beta for Tesla o the beta for the industry in this case! 4. You now need to calculate the cost of debt for Tesla. Go to markets.morningstar com/BondCenter, enter Tesla as the company, and find the yield to maturity for each of Tesla's bonds. What is the weighted average cost of debt for Testing the book value weights and the market value weights? Does it make a difference in this case if you use book value weights or market value weights? 5. You now have all the necessary information to calculate the weighted average cost of capital for Tesla. Calculate the weighted average cost of capital for SMEssing book value weights and market value weights assuming SM has a 21 percent marginal tax rate. Which cost of capital number is more relevant? 6. You used Tesla as a representative company to estimate the cost of capital for SML What are some of the potential problems with this approach in this situation? What improve ments might you suggest? Mini Case COST OF CAPITAL FOR SWAN MOTORS You une ty teen by Swee Moon M. de SM w founded by Joe Sundhed to manufacture chaper battery with sucher mitha was rely po i acar powered by the lanery mag of 700 miles being a car. The can manufactured by SME re midday preth the com other to manufacturer. The company by sendin dat les of 97 milyar SMI primarily who customers who was the chose a la number of ownedenis. The customer Section deposit of 30 percent of the purchase price her the one is the under tally within 15 days SMS des comowes het and on 427 used in its capital boditing process. Joe has about capital big chinhas come to you for help. For starters, the company las nove ind denne cost of capital and Joe would like you to perform the analysis Become the company is privacy owned, it is difficult to determine the cost of equity for the colorants you to use the pure play approach to estimate the cost of capital for SM has chosen Tesla Motors as a representative company. The following questions will lead you through the eps to calice late this estimate 1. Most publicly traded corporations are required to 100 quarters and 10K (annual reports to the SEC detailing their financial operations are the previous quarter or year, respectively. These corporate filings are wailable on the SEC www. pov. Go to the SEC website, follow the "Company Finland such for SEC filing made by Testa Find the most recent 100 und 10-K and download the fores. Look on the balance sheet to find the book value of debt and the book value of equity. If you look further down the report, you should find a section titled either "Lone Term Debt" or "Long-Term Debt and Interest Rate Risk Management that will lista breakdown of Tesla's long-term debt. 2. To estimate the cost of equity for Tesla o te finance.yahoo.com and enter the ticket symbol "TSLA" Follow the various links to find answers to the following questions What is the most recent stock price listed for Tesla? What is the market value of equity, or market capitalization? How many shares of stock does Teslaan outstanding What is the beta for Tesla? Now go back to finance.yahoo.com and follow the Markets und "US Treasury Bonds Rates links. What is the yield on mooth Treasury Using a 7 percent market risk premium, what is the cost of equity for Testing the CAPM? 3. Go to www.reuters.com and find the list of competitors in the industry. Find the beta for cach of these competitors and then calculate the industry average beta. Using the industry average beta, what is the cost of equity? Does it matter if you use the beta for Tesla o the beta for the industry in this case! 4. You now need to calculate the cost of debt for Tesla. Go to markets.morningstar com/BondCenter, enter Tesla as the company, and find the yield to maturity for each of Tesla's bonds. What is the weighted average cost of debt for Testing the book value weights and the market value weights? Does it make a difference in this case if you use book value weights or market value weights? 5. You now have all the necessary information to calculate the weighted average cost of capital for Tesla. Calculate the weighted average cost of capital for SMEssing book value weights and market value weights assuming SM has a 21 percent marginal tax rate. Which cost of capital number is more relevant? 6. You used Tesla as a representative company to estimate the cost of capital for SML What are some of the potential problems with this approach in this situation? What improve ments might you suggest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts