Question: answer c and d Question 3 A hedge fund manager decided to implement a 3-month carry trade strategy using currencies Z and Y. At the

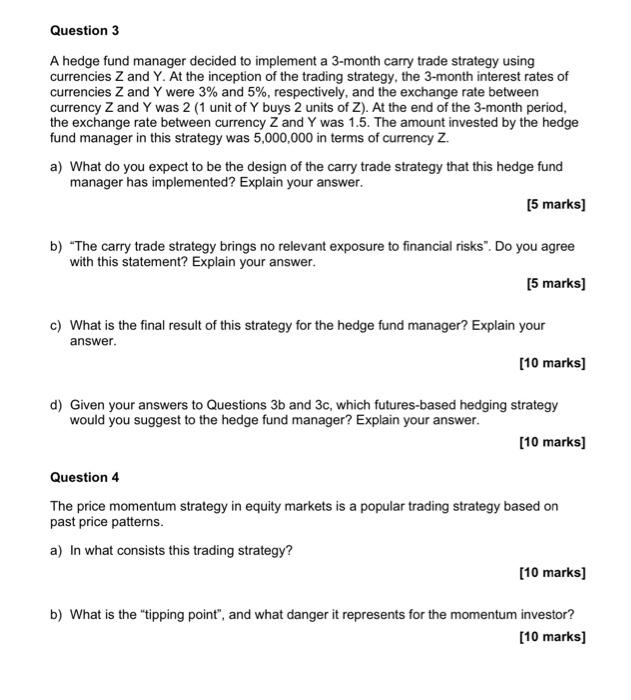

Question 3 A hedge fund manager decided to implement a 3-month carry trade strategy using currencies Z and Y. At the inception of the trading strategy, the 3-month interest rates of currencies Z and Y were 3% and 5%, respectively, and the exchange rate between currency Z and Y was 2 (1 unit of Y buys 2 units of Z). At the end of the 3-month period, the exchange rate between currency Z and Y was 1.5. The amount invested by the hedge fund manager in this strategy was 5,000,000 in terms of currency Z. a) What do you expect to be the design of the carry trade strategy that this hedge fund manager has implemented? Explain your answer. [5 marks] b) "The carry trade strategy brings no relevant exposure to financial risks". Do you agree with this statement? Explain your answer. [5 marks] c) What is the final result of this strategy for the hedge fund manager? Explain your answer. [10 marks] d) Given your answers to Questions 35 and 3c, which futures-based hedging strategy would you suggest to the hedge fund manager? Explain your answer. [10 marks] Question 4 The price momentum strategy in equity markets is a popular trading strategy based on past price patterns. a) In what consists this trading strategy? [10 marks] b) What is the "tipping point", and what danger it represents for the momentum investor? [10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts