Question: On June 1, 2024, Concord Opportunity Ltd. (CO) purchased a piece of equipment for $35,280. At the time, management determined that the equipment would

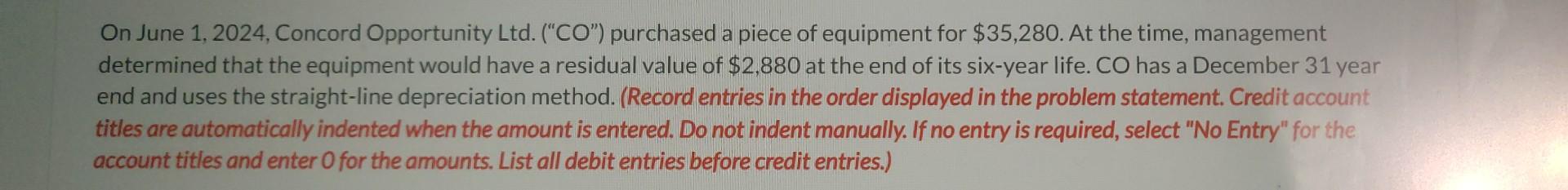

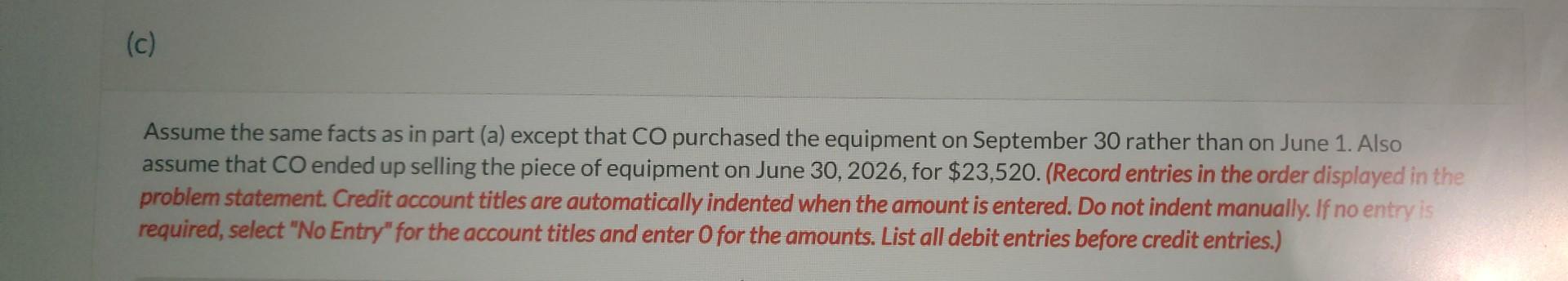

On June 1, 2024, Concord Opportunity Ltd. ("CO") purchased a piece of equipment for $35,280. At the time, management determined that the equipment would have a residual value of $2,880 at the end of its six-year life. CO has a December 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (c) Assume the same facts as in part (a) except that CO purchased the equipment on September 30 rather than on June 1. Also assume that CO ended up selling the piece of equipment on June 30, 2026, for $23,520. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Answer Explanation Date 202410 30 35 280 2880 6 Yearly depreciation on equipment as per str... View full answer

Get step-by-step solutions from verified subject matter experts