Question: Answer c) only PART B (TOPIC 7) Yuri, a non-Malaysian resident sold her bungalow for RM567,000 as evidenced by the sales & Purchase Agreement dated

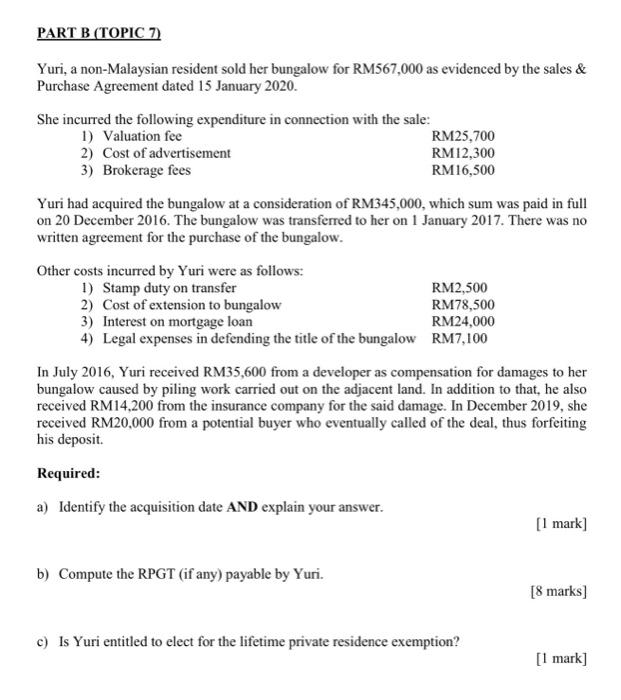

PART B (TOPIC 7) Yuri, a non-Malaysian resident sold her bungalow for RM567,000 as evidenced by the sales & Purchase Agreement dated 15 January 2020. She incurred the following expenditure in connection with the sale: 1) Valuation fee RM25,700 2) Cost of advertisement RM12,300 3) Brokerage fees RM16,500 Yuri had acquired the bungalow at a consideration of RM345,000, which sum was paid in full on 20 December 2016. The bungalow was transferred to her on 1 January 2017. There was no written agreement for the purchase of the bungalow. Other costs incurred by Yuri were as follows: 1) Stamp duty on transfer RM2,500 2) Cost of extension to bungalow RM78,500 3) Interest on mortgage loan RM24,000 4) Legal expenses in defending the title of the bungalow RM7,100 In July 2016, Yuri received RM35,600 from a developer as compensation for damages to her bungalow caused by piling work carried out on the adjacent land. In addition to that, he also received RM14.200 from the insurance company for the said damage. In December 2019, she received RM20,000 from a potential buyer who eventually called of the deal, thus forfeiting his deposit. Required: a) Identify the acquisition date AND explain your answer. [1 mark] b) Compute the RPGT (if any) payable by Yuri. [8 marks) c) Is Yuri entitled to elect for the lifetime private residence exemption? [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts