Question: answer C . please explain the steps on how to solve it 9. Stan sells land held for investment (AB $70,000) to his sister, Gail,

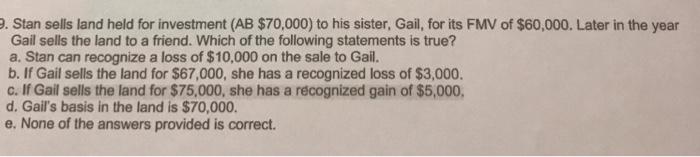

9. Stan sells land held for investment (AB $70,000) to his sister, Gail, for its FMV of $60,000. Later in the year Gail sells the land to a friend. Which of the following statements is true? a. Stan can recognize a loss of $10,000 on the sale to Gail. b. If Gail sells the land for $67,000, she has a recognized loss of $3,000. c. If Gail sells the land for $75,000, she has a recognized gain of $5,000, d. Gail's basis in the land is $70,000. e. None of the answers provided is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts