Question: answer c1 and c2 Suppose the yleld on short-term government securities (percelved to be risk-free) is about 4%. Suppose also that the expected return required

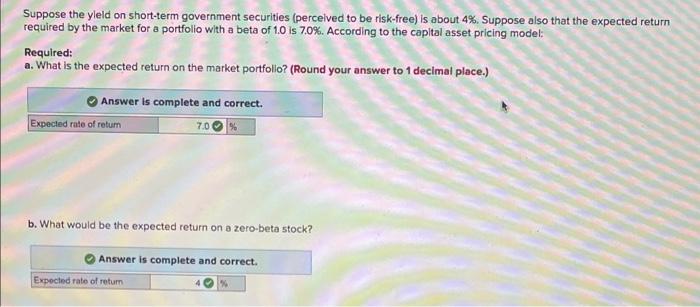

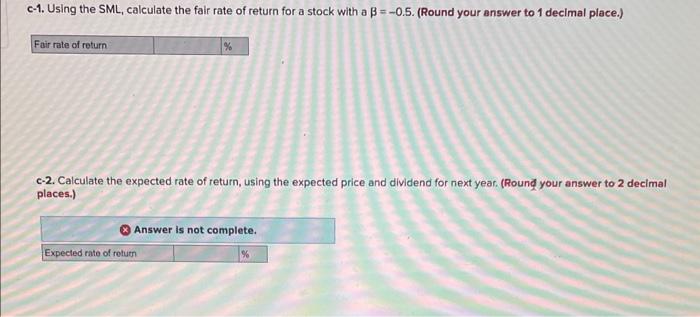

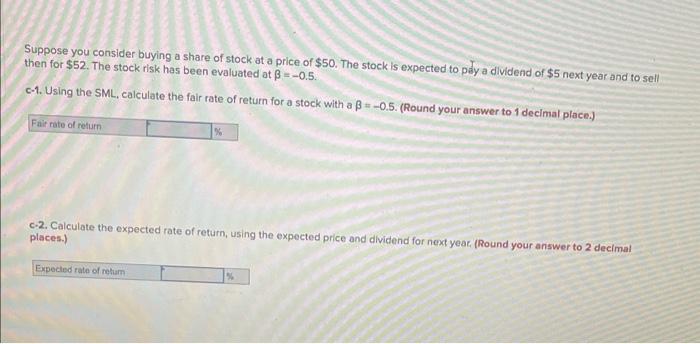

Suppose the yleld on short-term government securities (percelved to be risk-free) is about 4%. Suppose also that the expected return required by the market for a portfolio with a beta of 1.0 is 7.0%. According to the capltal asset pricing model: Required: a. What is the expected return on the market portfollo? (Round your answer to 1 decimal place.) b. What would be the expected return on a zero-beta stock? c-1. Using the SML, calculate the fale rate of return for a stock with a =0.5. (Round your answer to 1 decimal place.) c-2. Calculate the expected rate of return, using the expected price and dividend for next year. (Round your answer to 2 decimal places.) Suppose you consider buying a share of stock at a price of $50. The stock is expected to pay a dividend of $5 next year and to sell then for $52. The stock risk has been evaluated at =0.5. c-1. Using the SML, calculate the fair rate of return for a stock with a =0.5. (Round your answer to 1 decimal place.) c-2. Calculate the expected rate of return, using the expected price and dividend for next yeac (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts