Question: Answer choices A. $70 B. $67 C. $74 D. $79 C A https://ezto.mheduca... Not syncing pply: Capital and Capital Str.. Saved Help Save & Exit

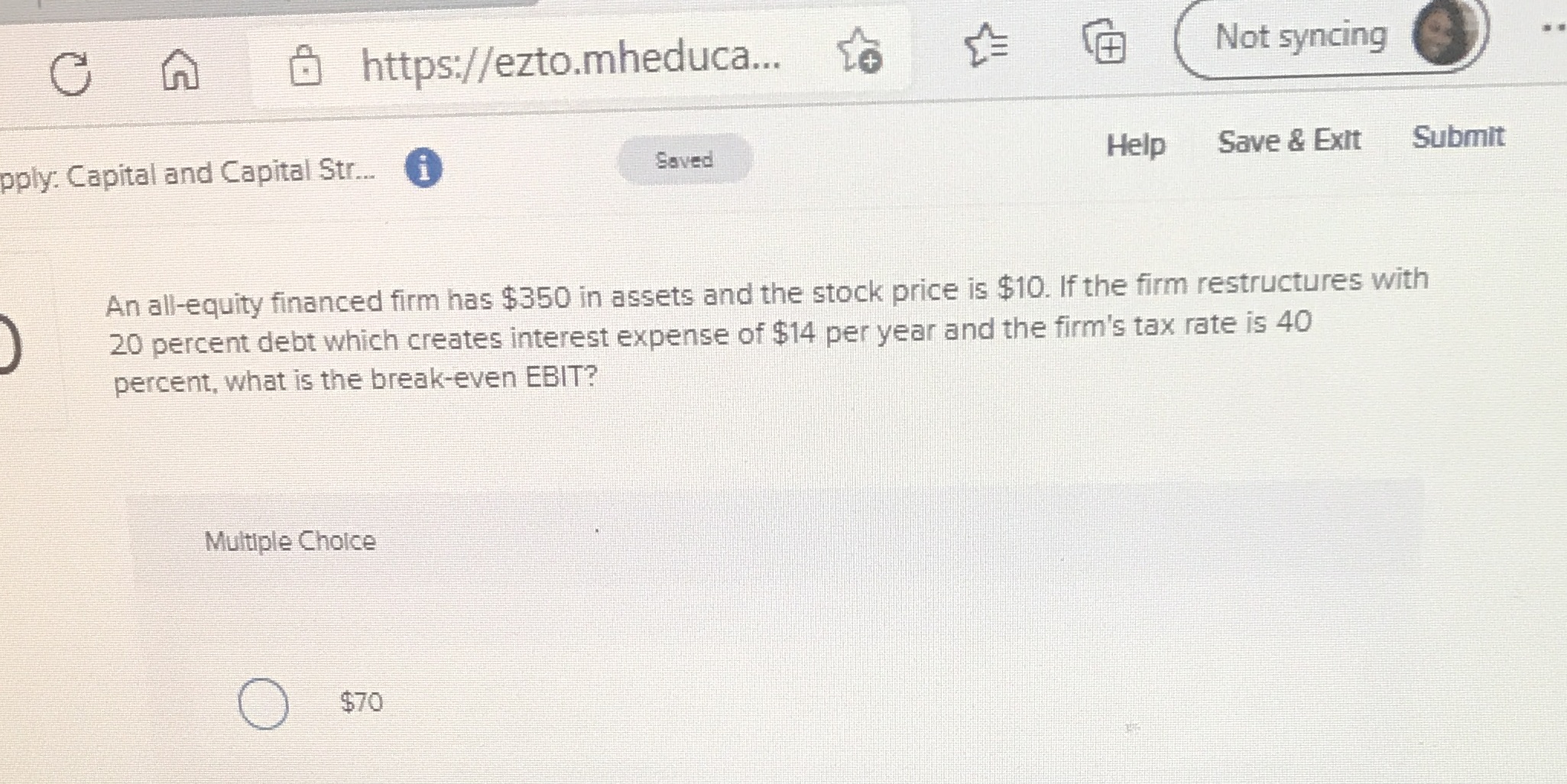

Answer choices A. $70 B. $67 C. $74 D. $79

C A https://ezto.mheduca... Not syncing pply: Capital and Capital Str.. Saved Help Save & Exit Submit An all-equity financed firm has $350 in assets and the stock price is $10. If the firm restructures with 20 percent debt which creates interest expense of $14 per year and the firm's tax rate is 40 percent, what is the break-even EBIT? Multiple Choice O $70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts