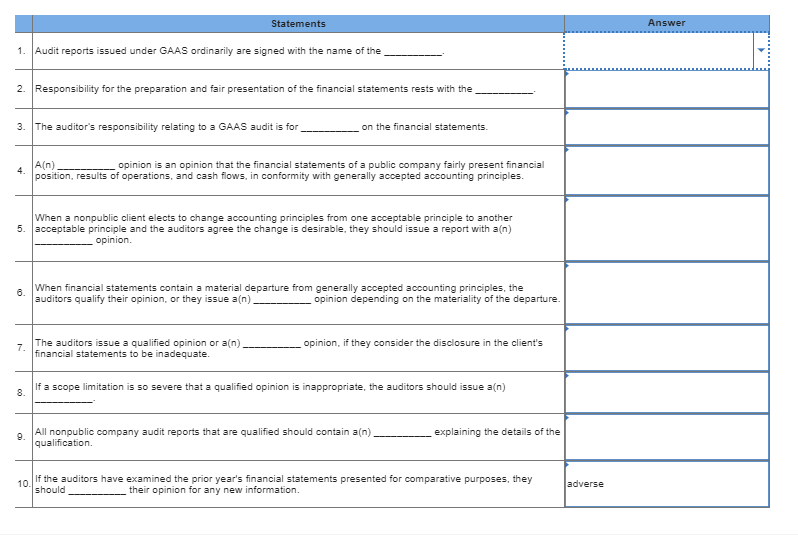

Question: Answer Choices: Adverse Basis for modification paragraph (or basis for qualified opinion paragraph) CPA firm Disclaimer of opinion Expressing an opinion Management Unmodified Unqualified Update

Answer Choices:

Adverse

Basis for modification paragraph (or basis for qualified opinion paragraph)

CPA firm

Disclaimer of opinion

Expressing an opinion

Management

Unmodified

Unqualified

Update

Statements Answer 1. Audit reports issued under GAAS ordinarily are signed with the name of the 2. Responsibility for the preparation and fair presentation of the financial statements rests with the 3. The auditor's responsibility relating to a GAAS audit is for on the financial statements. 4. A(n) opinion is an opinion that the financial statements of a public company fairly present financial position, results of operations, and cash flows, in conformity with generally accepted accounting principles. When a nonpublic client elects to change accounting principles from one acceptable principle to another 5. acceptable principle and the auditors agree the change is desirable, they should issue a report with a(n) opinion. 8. When financial statements contain a material departure from generally accepted accounting principles, the auditors qualify their opinion, or they issue an). opinion depending on the materiality of the departure. 7. The auditors issue a qualified opinion or a(n) financial statements to be inadequate. opinion, if they consider the disclosure in the client's If a scope limitation is so severe that a qualified opinion is inappropriate, the auditors should issue a(n) 8. 9 All nonpublic company audit reports that are qualified should contain a(n) qualification explaining the details of the 10. If the auditors have examined the prior year's financial statements presented for comparative purposes, they should their opinion for any new information adverse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts