Question: Answer Choices: Buy or Sell and between quantities 1-9 Consider three 5-year regular coupon bonds; each bond has a face value of $100. All bonds

Answer Choices: Buy or Sell and between quantities 1-9

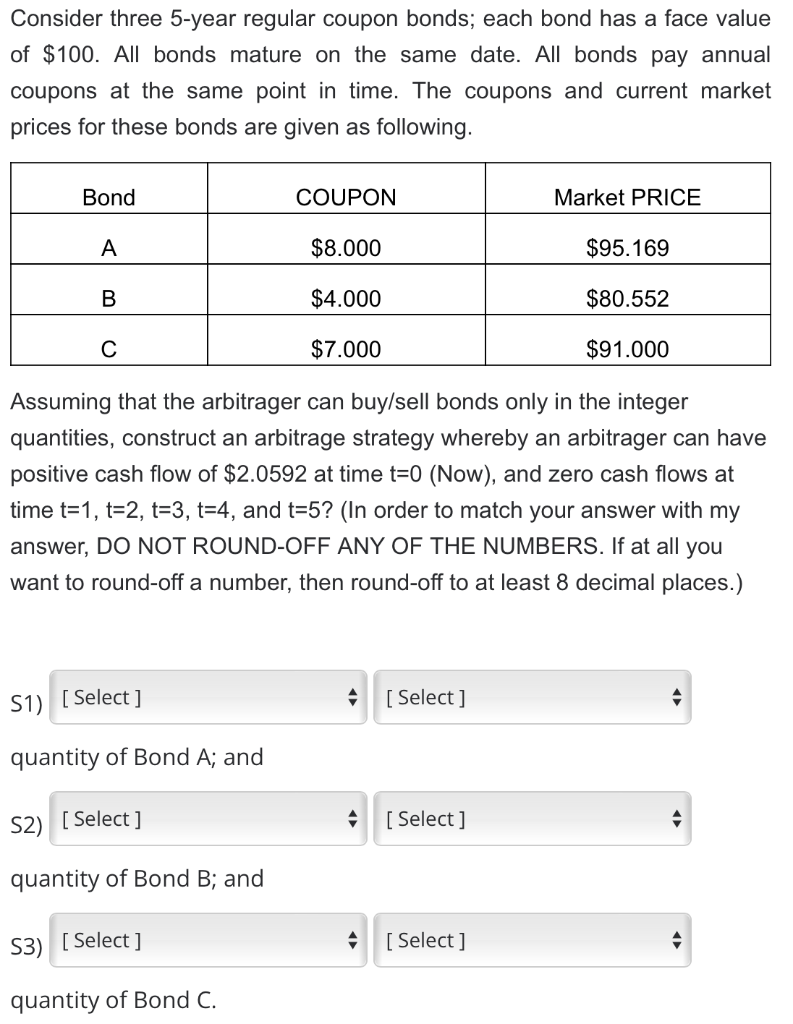

Consider three 5-year regular coupon bonds; each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons and current market prices for these bonds are given as following. Bond COUPON Market PRICE A $8.000 $95.169 B $4.000 $80.552 $7.000 $91.000 Assuming that the arbitrager can buy/sell bonds only in the integer quantities, construct an arbitrage strategy whereby an arbitrager can have positive cash flow of $2.0592 at time t=0 (Now), and zero cash flows at time t=1, t=2, t=3, t=4, and t=5? (In order to match your answer with my answer, DO NOT ROUND-OFF ANY OF THE NUMBERS. If at all you want to round-off a number, then round-off to at least 8 decimal places.) S1) [Select ] [ Select ] 4 quantity of Bond A; and S2) [Select] 4 [ Select ] quantity of Bond B; and S3) [ Select ] A [ Select] 4 quantity of Bond C. Consider three 5-year regular coupon bonds; each bond has a face value of $100. All bonds mature on the same date. All bonds pay annual coupons at the same point in time. The coupons and current market prices for these bonds are given as following. Bond COUPON Market PRICE A $8.000 $95.169 B $4.000 $80.552 $7.000 $91.000 Assuming that the arbitrager can buy/sell bonds only in the integer quantities, construct an arbitrage strategy whereby an arbitrager can have positive cash flow of $2.0592 at time t=0 (Now), and zero cash flows at time t=1, t=2, t=3, t=4, and t=5? (In order to match your answer with my answer, DO NOT ROUND-OFF ANY OF THE NUMBERS. If at all you want to round-off a number, then round-off to at least 8 decimal places.) S1) [Select ] [ Select ] 4 quantity of Bond A; and S2) [Select] 4 [ Select ] quantity of Bond B; and S3) [ Select ] A [ Select] 4 quantity of Bond C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts