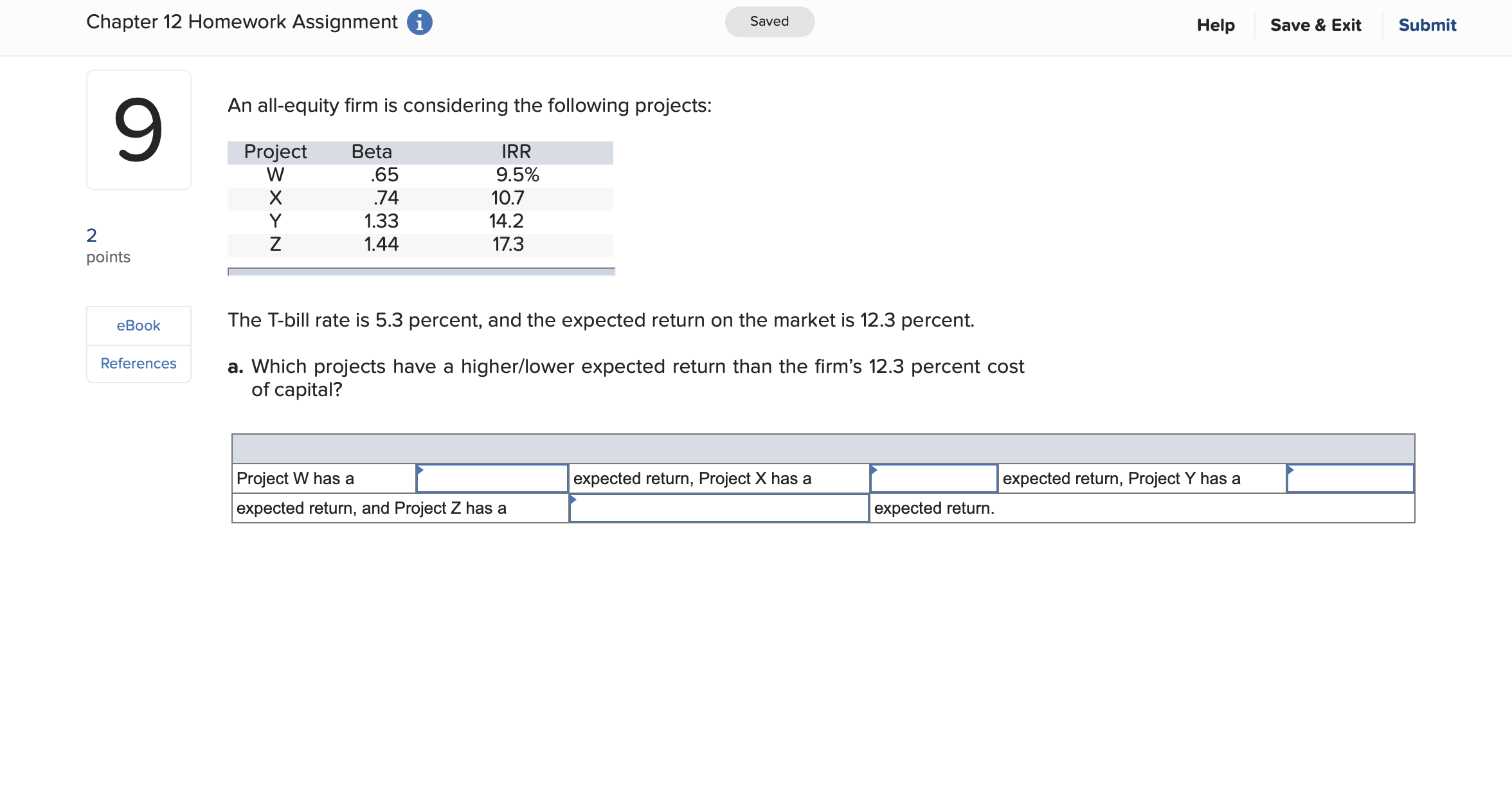

Question: ANSWER CHOICES FOR PART A: higher, lower ANSWER CHOICES FOR PART B: accepted, rejected ANSWER CHOICES FOR PART C: correctly accepted, correctly rejected, incorrectly accepted,

ANSWER CHOICES FOR PART A: higher, lower

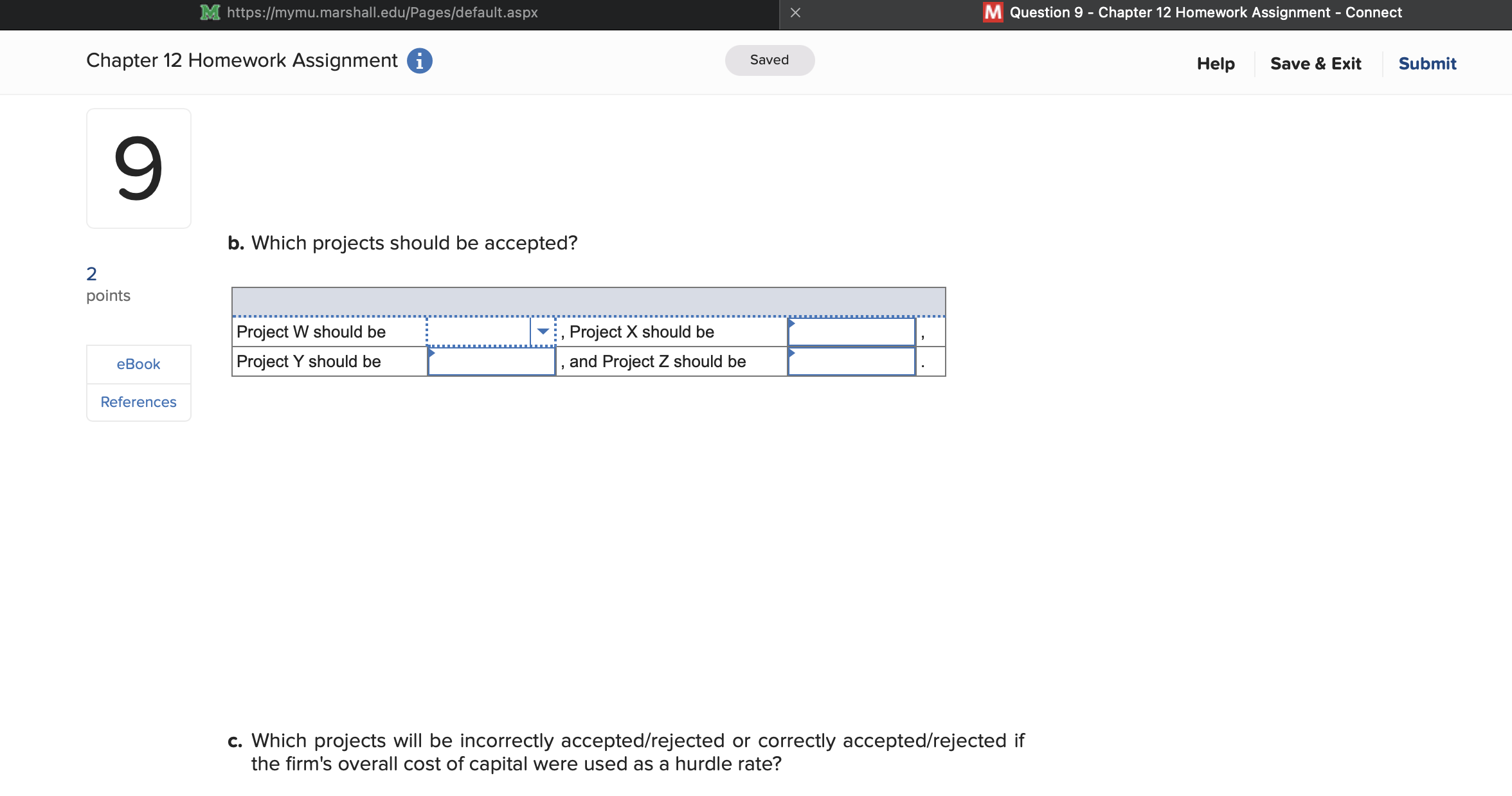

ANSWER CHOICES FOR PART B: accepted, rejected

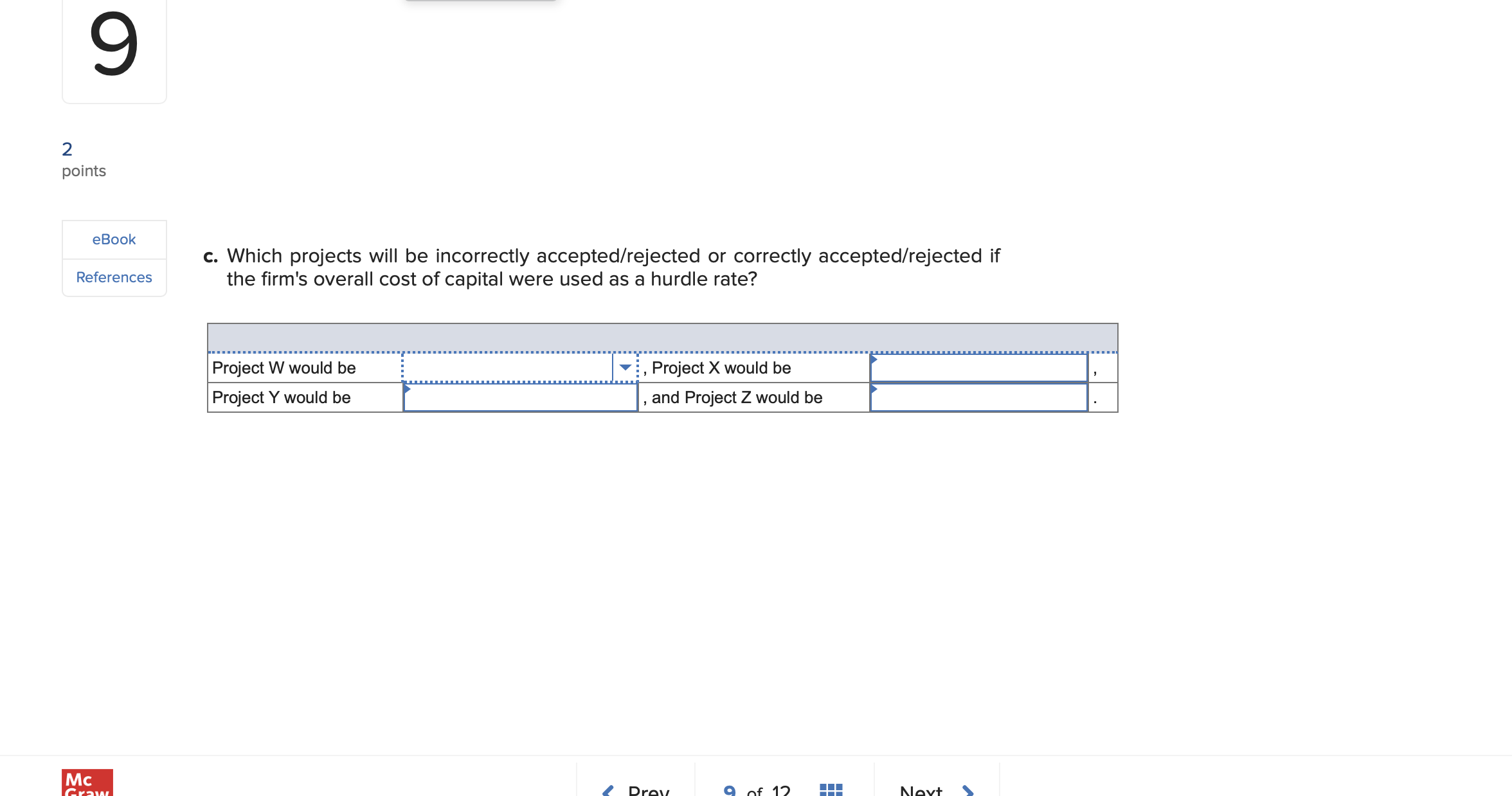

ANSWER CHOICES FOR PART C: correctly accepted, correctly rejected, incorrectly accepted, incorrectly rejected

Chapter 12 Homework Assignment i An all-equity firm is considering the following projects: 2 points \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ eBook } & The T-bill rate is 5.3 percent, and the expected return on the market is 12.3 percent. \\ \hline References & a.Whichprojectshaveahigher/lowerexpectedreturnthanthefirms12.3percentcostofcapital? \end{tabular} M https://mymu.marshall.edu/Pages/default.aspx x M Question 9 - Chapter 12 Homework Assignment - Connect Chapter 12 Homework Assignment i b. Which projects should be accepted? 2 points c. Which projects will be incorrectly accepted/rejected or correctly accepted/rejected if the firm's overall cost of capital were used as a hurdle rate? c. Which projects will be incorrectly accepted/rejected or correctly accepted/rejected if the firm's overall cost of capital were used as a hurdle rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts