Question: answer choices: problem 2: answer choices: One of the risks when investing in bonds is that when interest rates increase (decline) prices of bonds decline

answer choices:

problem 2:

answer choices:

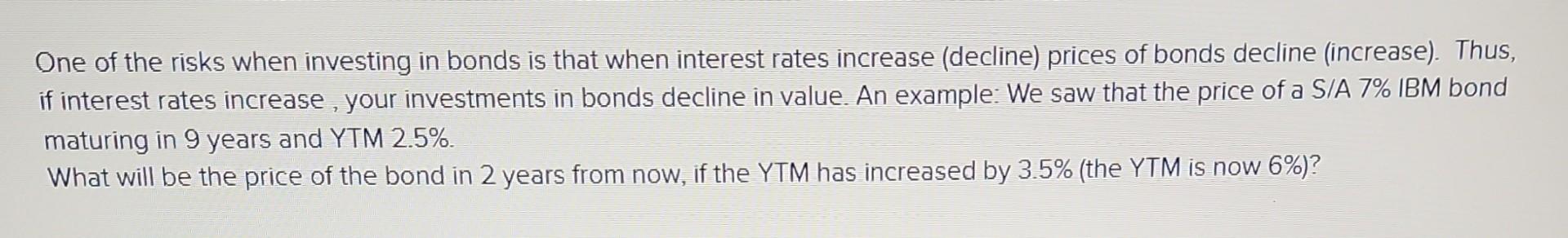

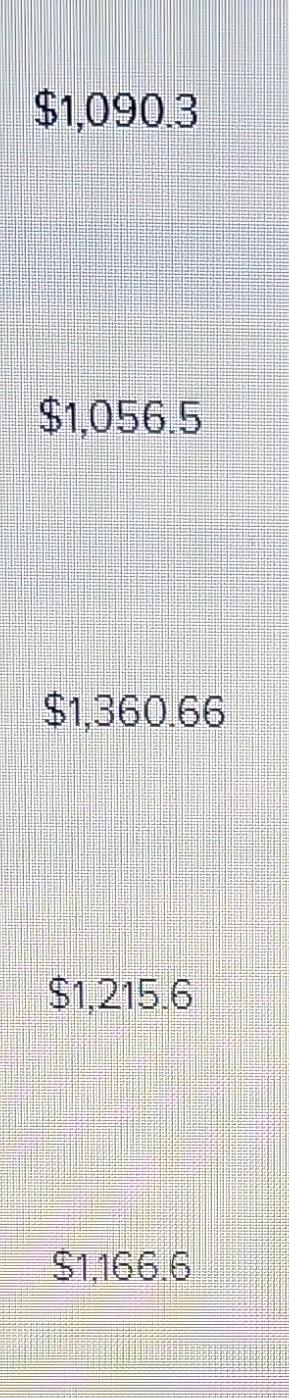

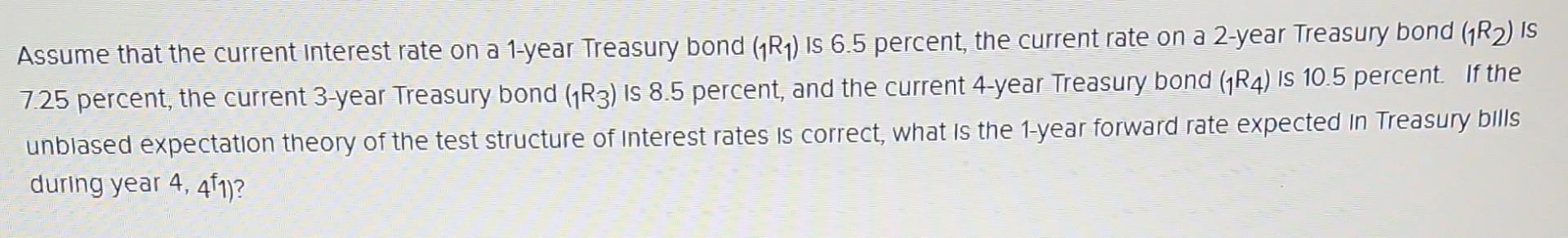

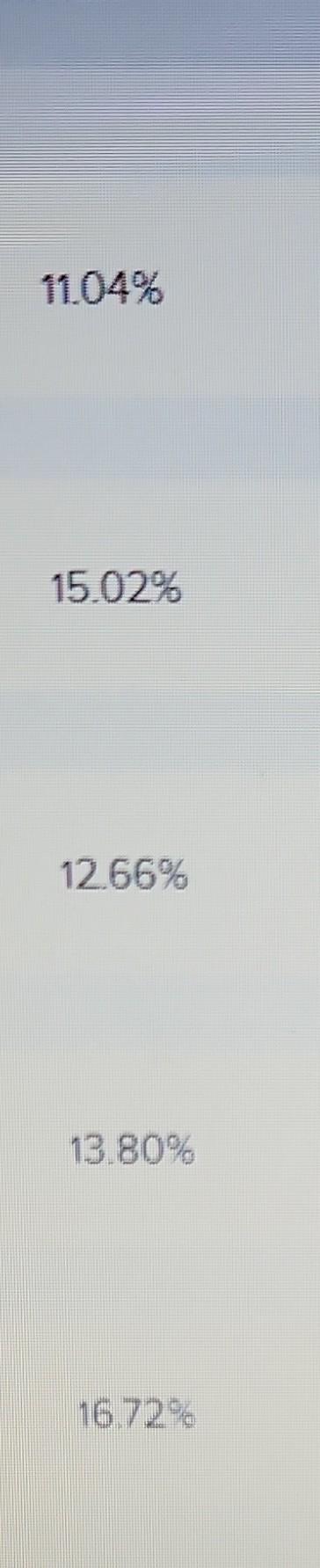

One of the risks when investing in bonds is that when interest rates increase (decline) prices of bonds decline (increase). Thus, if interest rates increase, your investments in bonds decline in value. An example: We saw that the price of a S/A 7% IBM bond maturing in 9 years and YTM 2.5%. What will be the price of the bond in 2 years from now, if the YTM has increased by 3.5% (the YTM is now 6% )? $1,090.3 $1,056.5 $1,360.66 $1,215.6 $1,166.6 Assume that the current interest rate on a 1-year Treasury bond (1R1) is 6.5 percent, the current rate on a 2 -year Treasury bond ( 1R2) is 7.25 percent, the current 3-year Treasury bond (1R3) Is 8.5 percent, and the current 4-year Treasury bond (1R4) is 10.5 percent. If the unbiased expectation theory of the test structure of Interest rates Is correct, what Is the 1-year forward rate expected In Treasury bills during year 4,4f1) ? 13.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts