Question: Answer complete question correct and as per the requirement. If you are planning to answer wrong or incomplete then stay away. Answer in editable format,

Answer complete question correct and as per the requirement. If you are planning to answer wrong or incomplete then stay away. Answer in editable format, typed. Not handwritten. Answer all profits and strategies.

Follow the instructions to get thumbs up and good feedback. Only typed and editable answers.

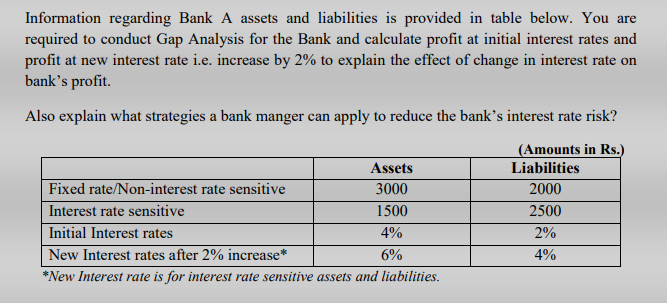

Information regarding Bank A assets and liabilities is provided in table below. You are required to conduct Gap Analysis for the Bank and calculate profit at initial interest rates and profit at new interest rate i.e. increase by 2% to explain the effect of change in interest rate on bank's profit. Also explain what strategies a bank manger can apply to reduce the bank's interest rate risk? Assets Fixed rate/Non-interest rate sensitive 3000 Interest rate sensitive 1500 Initial Interest rates 4% New Interest rates after 2% increase* 6% *New Interest rate is for interest rate sensitive assets and liabilities. (Amounts in Rs.) Liabilities 2000 2500 2% 4% Information regarding Bank A assets and liabilities is provided in table below. You are required to conduct Gap Analysis for the Bank and calculate profit at initial interest rates and profit at new interest rate i.e. increase by 2% to explain the effect of change in interest rate on bank's profit. Also explain what strategies a bank manger can apply to reduce the bank's interest rate risk? Assets Fixed rate/Non-interest rate sensitive 3000 Interest rate sensitive 1500 Initial Interest rates 4% New Interest rates after 2% increase* 6% *New Interest rate is for interest rate sensitive assets and liabilities. (Amounts in Rs.) Liabilities 2000 2500 2% 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts