Question: answer correct Question 11 (2 points) The earnings, dividends, and stock price of Motortech Inc. are expected to grow at 6% per year in the

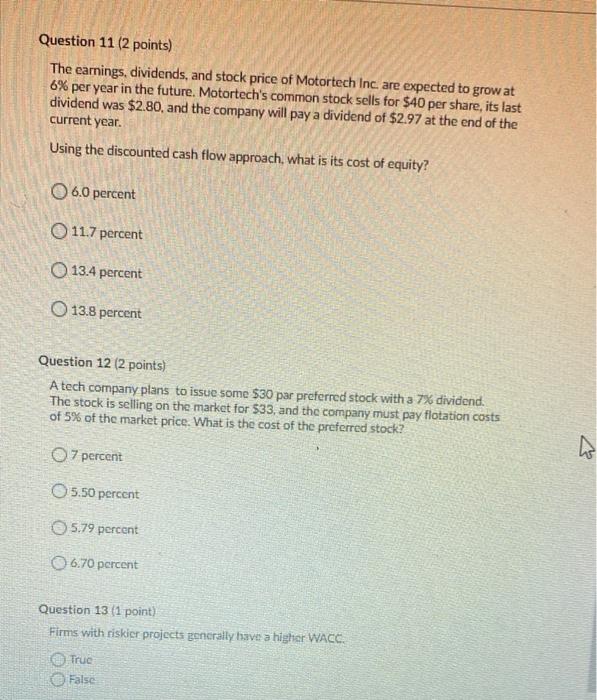

Question 11 (2 points) The earnings, dividends, and stock price of Motortech Inc. are expected to grow at 6% per year in the future. Motortech's common stock sells for $40 per share, its last dividend was $2.80, and the company will pay a dividend of $2.97 at the end of the current year. Using the discounted cash flow approach, what is its cost of equity? O 6.0 percent 11.7 percent 13.4 percent O 13.8 percent Question 12 (2 points) A tech company plans to issue some $30 par preferred stock with a 7% dividend. The stock is selling on the market for $33, and the company must pay flotation costs of 5% of the market price. What is the cost of the preferred stock? 07 percent O 5.50 percent 5.79 percent 6.70 percent Question 13 (1 point) Firms with riskier projects generally have a higher WACC. Truc False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts