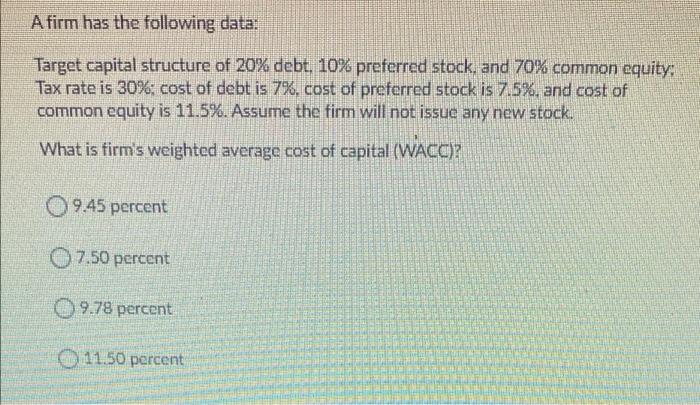

Question: answer correctly A firm has the following data: Target capital structure of 20% debt. 10% preferred stock, and 70% common equity; Tax rate is 30%

answer correctly

A firm has the following data: Target capital structure of 20% debt. 10% preferred stock, and 70% common equity; Tax rate is 30% cost of debt is 796, cost of preferred stock is 7.5%, and cost of common equity is 11.5%. Assume the firm will not issue any new stock. What is firm's weighted average cost of capital (WACC)? 9.45 percent 7.50 percent 9.78 percent 11.50 percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock