Question: Answer correctly please 4. Based on the Pecking Order hypothesis of capital structure, which source of financing do firms access first? a. Bank loans b.

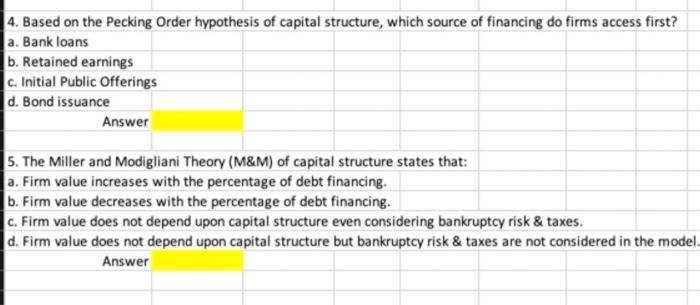

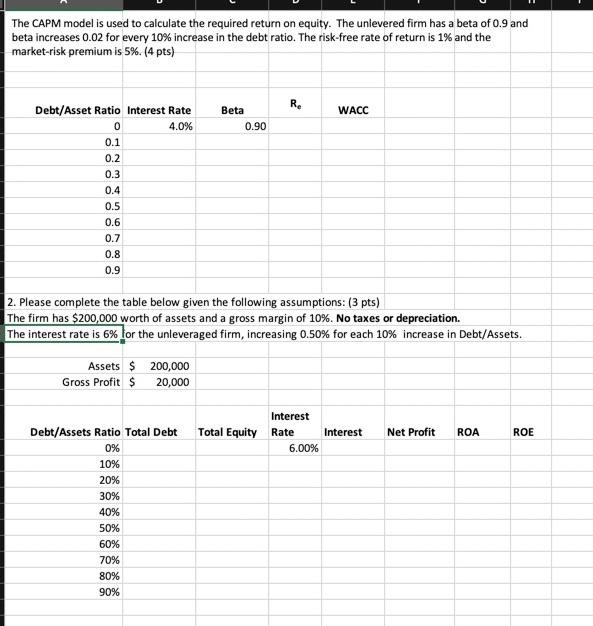

4. Based on the Pecking Order hypothesis of capital structure, which source of financing do firms access first? a. Bank loans b. Retained earnings c. Initial Public Offerings d. Bond issuance Answer 5. The Miller and Modigliani Theory (M&M) of capital structure states that: a. Firm value increases with the percentage of debt financing. b. Firm value decreases with the percentage of debt financing. c. Firm value does not depend upon capital structure even considering bankruptcy risk& taxes. d. Firm value does not depend upon capital structure but bankruptcy risk & taxes are not considered in the model Answer The CAPM model is used to calculate the required return on equity. The unlevered firm has a beta of 0.9 and beta increases 0.02 for every 10% increase in the debt ratio. The risk-free rate of return is 1% and the market-risk premium is 5%. (4 pts) Re WACC Beta 0.90 Debt/Asset Ratio Interest Rate 0 4.0% 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 2. Please complete the table below given the following assumptions: (3 pts) The firm has $200,000 worth of assets and a gross margin of 10%. No taxes or depreciation. The interest rate is 6% for the unleveraged firm, increasing 0.50% for each 10% increase in Debt/Assets. Assets $ 200,000 Gross Profit $ 20,000 Interest Total Equity Rate 6.00% Interest Net Profit ROA ROE Debt/Assets Ratio Total Debt 0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts