Question: answer d and e please Problem 2: Portable alpha and risk management Assume that you invest in a portfolio of 5 stocks splitting your money

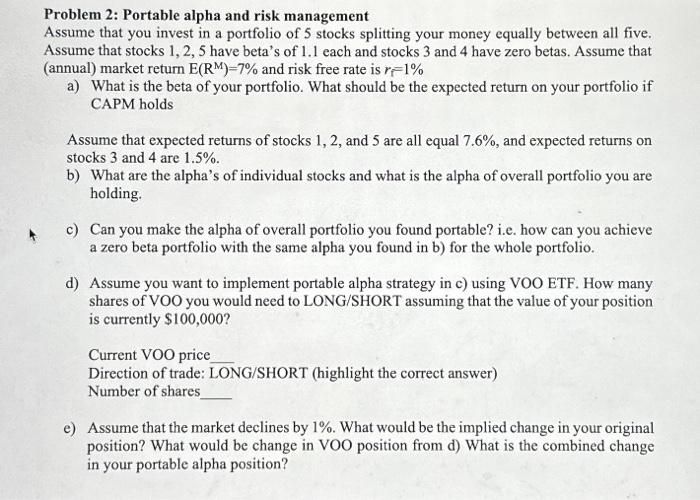

Problem 2: Portable alpha and risk management Assume that you invest in a portfolio of 5 stocks splitting your money equally between all five. Assume that stocks 1,2,5 have beta's of 1.1 each and stocks 3 and 4 have zero betas. Assume that (annual) market return E(RM)=7% and risk free rate is rf=1% a) What is the beta of your portfolio. What should be the expected return on your portfolio if CAPM holds Assume that expected returns of stocks 1,2 , and 5 are all equal 7.6%, and expected returns on stocks 3 and 4 are 1.5%. b) What are the alpha's of individual stocks and what is the alpha of overall portfolio you are holding. c) Can you make the alpha of overall portfolio you found portable? i.e. how can you achieve a zero beta portfolio with the same alpha you found in b) for the whole portfolio. d) Assume you want to implement portable alpha strategy in c) using VOO ETF. How many shares of VOO you would need to LONG/SHORT assuming that the value of your position is currently $100,000 ? Current VOO price Direction of trade: LONG/SHORT(highlightthecorrectanswer) Number of shares e) Assume that the market declines by 1%. What would be the implied change in your original position? What would be change in VOO position from d) What is the combined change in your portable alpha position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts