Question: Answer E23-4 using the data from E23-4 please *Answer E23-4 using data from E23-3 E23-4 (LO2,3) EXCEL (Preparation of Operating Activities Section-Direct Method) Data for

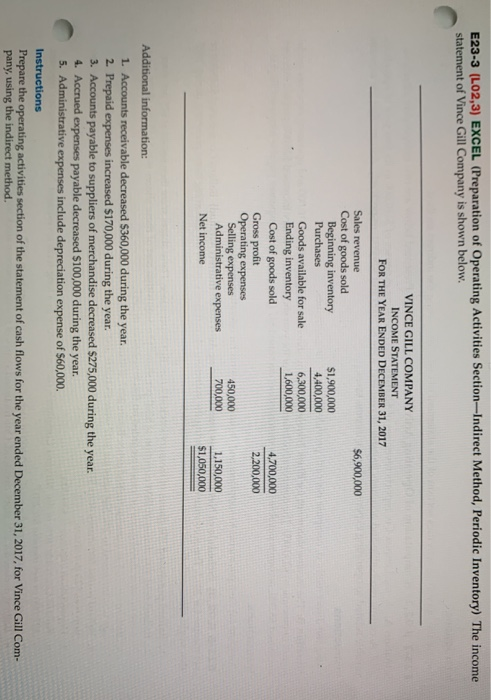

E23-4 (LO2,3) EXCEL (Preparation of Operating Activities Section-Direct Method) Data for the Vince Gill Company are presented in E23-3. Instructions Prepare the operating activities section of the statement of cash flows using the direct method. E23-3 (L02,3) EXCEL (Preparation of Operating Activities Section-Indirect Method, Periodic Inventory) The income statement of Vince Gill Company is shown below. VINCE GILL COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2017 Sales revenue Cost of goods sold Beginning inventory Purchases $6,900,000 $1,900,000 4,400,000 Goods available for sale 6,300,000 1,600,000 Ending inventory Cost of goods sold Gross profit Operating expenses Selling expenses Administrative expenses 4,700,000 2,200,000 450,000 700,000 1,150,000 Net income $1,050,000 Additional information: 1. Accounts receivable decreased $360,000 during the year. 2. Prepaid expenses increased $170,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $275,000 during the year 4. Accrued expenses payable decreased $100,000 during the year. 5. Administrative expenses include depreciation expense of $60,000. Instructions Prepare the operating activities section of the statement of cash flows for the year ended December 31, 2017, for Vince Gill Com- pany, using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts