Question: Answer each letter and provide a comprehensive explanation for each answer. Morris & Assoc., owned by Cindy Morris, provides accounting services to clients. The firm

Answer each letter and provide a comprehensive explanation for each answer.

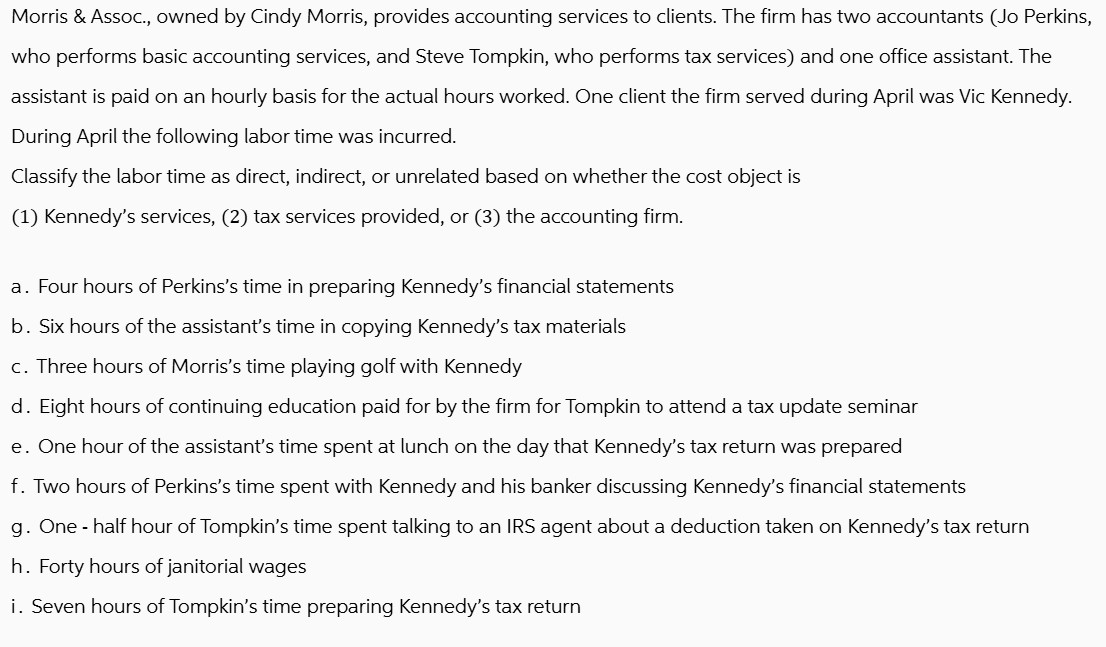

Morris & Assoc., owned by Cindy Morris, provides accounting services to clients. The firm has two accountants Jo Perkins,

who performs basic accounting services, and Steve Tompkin, who performs tax services and one office assistant. The

assistant is paid on an hourly basis for the actual hours worked. One client the firm served during April was Vic Kennedy.

During April the following labor time was incurred.

Classify the labor time as direct, indirect, or unrelated based on whether the cost object is

Kennedy's services, tax services provided, or the accounting firm.

a Four hours of Perkins's time in preparing Kennedy's financial statements

b Six hours of the assistant's time in copying Kennedy's tax materials

c Three hours of Morris's time playing golf with Kennedy

d Eight hours of continuing education paid for by the firm for Tompkin to attend a tax update seminar

e One hour of the assistant's time spent at lunch on the day that Kennedy's tax return was prepared

f Two hours of Perkins's time spent with Kennedy and his banker discussing Kennedy's financial statements

g One half hour of Tompkin's time spent talking to an IRS agent about a deduction taken on Kennedy's tax return

h Forty hours of janitorial wages

i Seven hours of Tompkin's time preparing Kennedy's tax return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock