Question: answer each part thank you. show work You are considering investing in a start up company. The founder asked you for $290,000 today and you

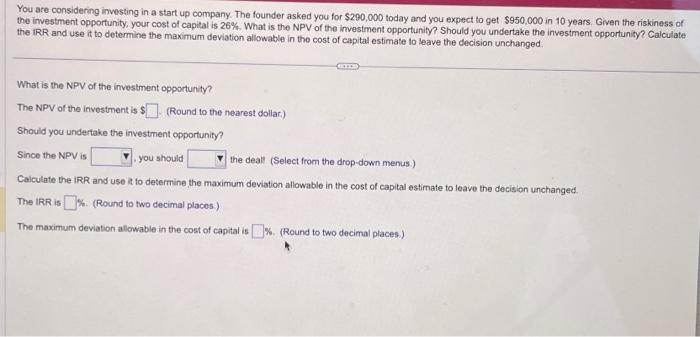

You are considering investing in a start up company. The founder asked you for $290,000 today and you expect to get $950,000 in 10 years. Given the riskiness of the investment opportunity, your cost of capital is 26%. What is the NPV of the investment opportunity? Should you undertake the investment opportunity? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. What is the NPV of the investment opportunity? The NPV of the investment is \$ (Round to the nearest dollar.) Should you undertake the investment opportunity? Since the NPV is you should the deall (Select from the drop-down menus.) Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. The IRR is k. (Round to two decimal places.) The maximum deviation allowable in the cost of capital is K. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts