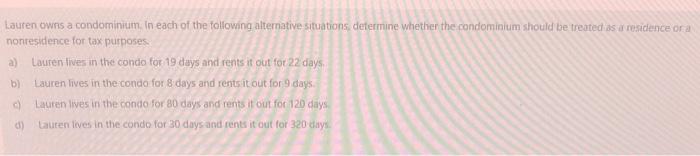

Question: answer each question clearly Lauren owns a condominium in each of the following alternative situations determine whether the condominium should be treated as a residence

answer each question clearly

Lauren owns a condominium in each of the following alternative situations determine whether the condominium should be treated as a residence or nonresidence for tax purposes Lauren lives in the condo for 19 days and rents it out for 22 days b) Lauren lives in the condo for 8 days and rents it out for 9 days Lauren lives in the condo for 80 days and rents it out for 120 days Lauren lives in the condo for 30 days and tents it out for 320 days

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock