Question: Home Budgeting After renting for a few years, you decide it is time to purchase your own home. Before purchasing a house, you want

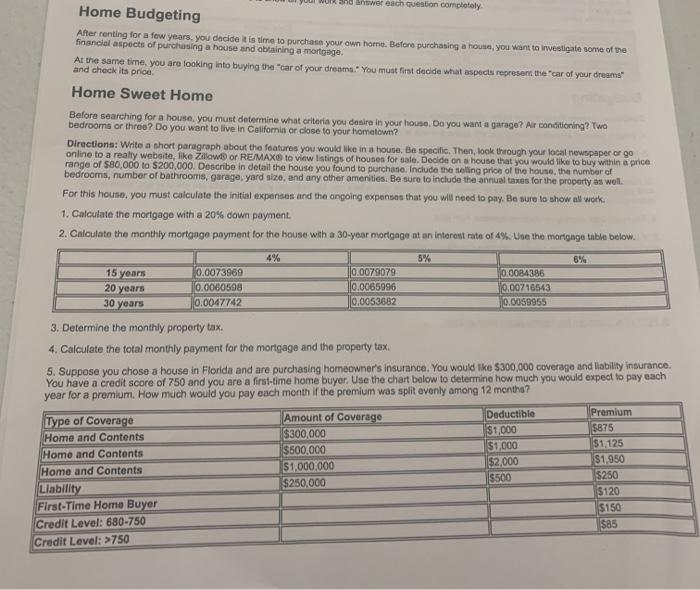

Home Budgeting After renting for a few years, you decide it is time to purchase your own home. Before purchasing a house, you want to investigate some of the financial aspects of purchasing a house and obtaining a mortgage. At the same time, you are looking into buying the "car of your dreams." You must first decide what aspects represent the "car of your dreams" and check Home Sweet Home Before searching for a house, you must determine what criteria you desire in your house. Do you want a garage? Air conditioning? Two bedrooms or three? Do you want to live in California or close to your hometown? and answer each question completely Directions: Write a short paragraph about the features you would like in a house. Be specific. Then, look through your local newspaper or go online to a realty website, like Zillow or RE/MAX to view listings of houses for sale. Decide on a house that you would like to buy within a price range of $80,000 to $200,000. Describe in detail the house you found to purchase. Include the selling price of the house, the number of bedrooms, number of bathrooms, garage, yard size, and any other amenities. Be sure to include the annual taxes for the property as well. For this house, you must calculate the initial expenses and the angoing expenses that you will need to pay. Be sure to show all work. 1. Calculate the mortgage with a 20% down payment. 2. Calculate the monthly mortgage payment for the house with a 30-year mortgage at an interest rate of 4%. Use the mortgage table below. 4% 5% 15 years 20 years 30 years Type of Coverage Home and Contents Home and Contents Home and Contents 0.0073969 0.0060598 0.0047742 Liability First-Time Home Buyer Credit Level: 680-750 Credit Level: >750 0.0079079 0.0065996 0.0053682 3. Determine the monthly property tax. 4. Calculate the total monthly payment for the mortgage and the property tax. 5. Suppose you chose a house in Florida and are purchasing homeowner's insurance. You would like $300,000 coverage and liability insurance. You have a credit score of 750 and you are a first-time home buyer. Use the chart below to determine how much you would expect to pay each year for a premium. How much would you pay each month if the premium was split evenly among 12 months? 0.0084386 0.00716543 0.0059955 Amount of Coverage $300,000 $500,000 $1,000,000 $250,000 Deductible $1,000 $1,000 $2,000 $500 Premium $875 $1,125 $1,950 $250 $120 $150 $85 6. Suppose you pay $1,100 per month for rent and $35 per month for renter's insurance. Describe how the rent.d.conte's Insurance compares to your future mortgage and homeowner's insurance (including property taxes). Write your answer in compl

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER 1 The mortgage with a 20 down payment would be 160000 2 T... View full answer

Get step-by-step solutions from verified subject matter experts