Question: Answer ead Discussion problem 1 (20 points) A bank is in the process of renegotiating a three-year non-amortizing loan to Greece. The principal outstanding is

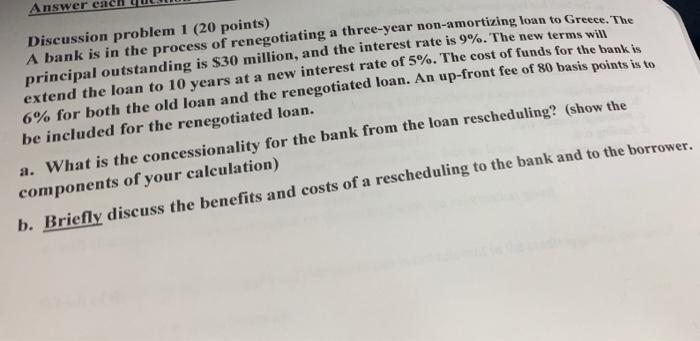

Answer ead Discussion problem 1 (20 points) A bank is in the process of renegotiating a three-year non-amortizing loan to Greece. The principal outstanding is $30 million, and the interest rate is 9%. The new terms will extend the loan to 10 years at a new interest rate of 5%. The cost of funds for the bank is 6% for both the old loan and the renegotiated loan. An up-front fee of 80 basis points is to be included for the renegotiated loan. a. What is the concessionality for the bank from the loan rescheduling? (show the components of your calculation) b. Briefly discuss the benefits and costs of a rescheduling to the bank and to the borrower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts