Question: answer everything correctly. i thumbs up The following facts apply to the pension plan of Wildhorse Inc for the year 2020. Plan assets, January 1,

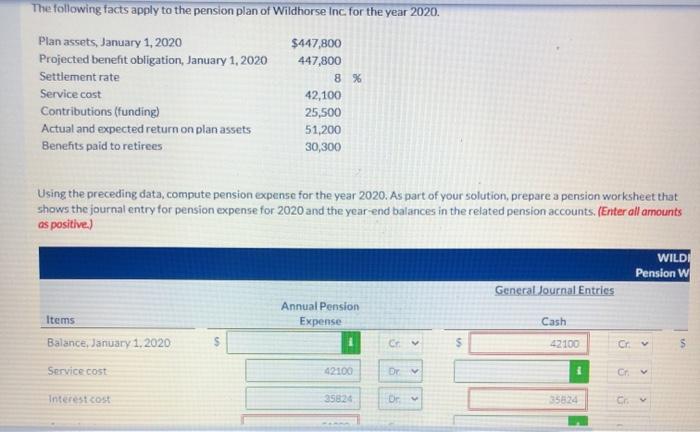

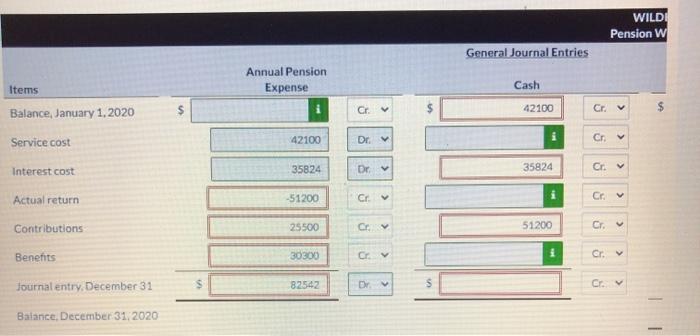

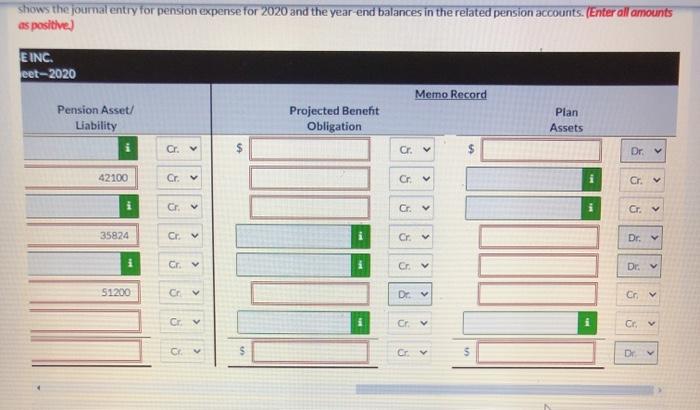

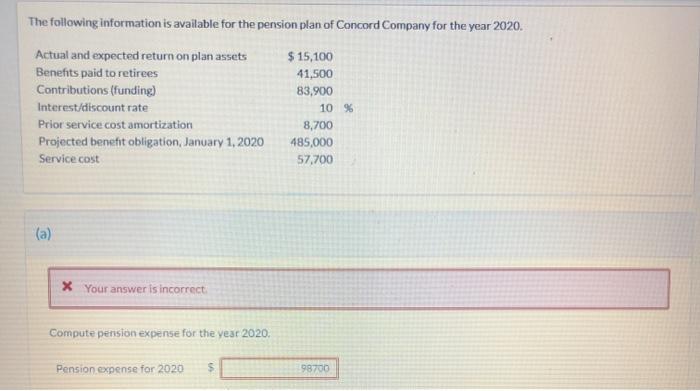

The following facts apply to the pension plan of Wildhorse Inc for the year 2020. Plan assets, January 1, 2020 Projected benefit obligation, January 1, 2020 Settlement rate Service cost Contributions (funding) Actual and expected return on plan assets Benefits paid to retirees $447,800 447,800 8 % 42,100 25,500 51,200 30,300 Using the preceding data, compute pension expense for the year 2020. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enter all amounts as positive.) WILDI Pension W General Journal Entries Items Annual Pension Expense Cash $ 42100 Crv Balance, January 1, 2020 Service cost 42100 Dr 1 CA Interest cost 35824 Or Crv WILDI Pension W General Journal Entries Annual Pension Expense Items Cash Balance, January 1, 2020 Cr. A 42100 Service cost 42100 Dr. Cr. v 35824 Interest cost 35824 Dr Or Actual return -51200 Cr > Contributions 25500 51200 Benefits 30300 Journal entry, December 31 S 82542 Cr Balance, December 31, 2020 shows the joumal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enterall amounts as positive.) WILDHORSE INC. Pension Worksheet-2020 ournal Entries Memo Record Cash Pension Asset/ Liability Projected Benefit Obligation 42100 $ Crv 42100 Cr. 35824 Cr. V Cr. v 35824 Cr Cr. v 51200 Cr. v Cr 1 Cr. v Crv 51200 Dr. CA CIV shows the joumal entry for pension expense for 2020 and the year end balances in the related pension accounts. (Enter all amounts as positive.) EINC. eet-2020 Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets Cr > Gr. Dr. 42100 Cr. i Gr. Cr. i Cr. 35824 Cr. Cr. Dr. Cr. Crv Dr. 51200 Dr. Cr > C Crv C 5 DI The following information is available for the pension plan of Concord Company for the year 2020. Actual and expected return on plan assets $ 15,100 Benefits paid to retirees 41,500 Contributions (funding) 83,900 Interest/discount rate 10 % Prior service cost amortization 8,700 Projected benefit obligation, January 1, 2020 485.000 Service cost 57,700 (a) X Your answer is incorrect Compute pension expense for the year 2020, Pension expense for 2020 98700 The following facts apply to the pension plan of Wildhorse Inc for the year 2020. Plan assets, January 1, 2020 Projected benefit obligation, January 1, 2020 Settlement rate Service cost Contributions (funding) Actual and expected return on plan assets Benefits paid to retirees $447,800 447,800 8 % 42,100 25,500 51,200 30,300 Using the preceding data, compute pension expense for the year 2020. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enter all amounts as positive.) WILDI Pension W General Journal Entries Items Annual Pension Expense Cash $ 42100 Crv Balance, January 1, 2020 Service cost 42100 Dr 1 CA Interest cost 35824 Or Crv WILDI Pension W General Journal Entries Annual Pension Expense Items Cash Balance, January 1, 2020 Cr. A 42100 Service cost 42100 Dr. Cr. v 35824 Interest cost 35824 Dr Or Actual return -51200 Cr > Contributions 25500 51200 Benefits 30300 Journal entry, December 31 S 82542 Cr Balance, December 31, 2020 shows the joumal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enterall amounts as positive.) WILDHORSE INC. Pension Worksheet-2020 ournal Entries Memo Record Cash Pension Asset/ Liability Projected Benefit Obligation 42100 $ Crv 42100 Cr. 35824 Cr. V Cr. v 35824 Cr Cr. v 51200 Cr. v Cr 1 Cr. v Crv 51200 Dr. CA CIV shows the joumal entry for pension expense for 2020 and the year end balances in the related pension accounts. (Enter all amounts as positive.) EINC. eet-2020 Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets Cr > Gr. Dr. 42100 Cr. i Gr. Cr. i Cr. 35824 Cr. Cr. Dr. Cr. Crv Dr. 51200 Dr. Cr > C Crv C 5 DI The following information is available for the pension plan of Concord Company for the year 2020. Actual and expected return on plan assets $ 15,100 Benefits paid to retirees 41,500 Contributions (funding) 83,900 Interest/discount rate 10 % Prior service cost amortization 8,700 Projected benefit obligation, January 1, 2020 485.000 Service cost 57,700 (a) X Your answer is incorrect Compute pension expense for the year 2020, Pension expense for 2020 98700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts