Question: Answer Ex 16-17 Using excel and describe how your answer was giving. All the information is given in the photos. Thank you, I will let

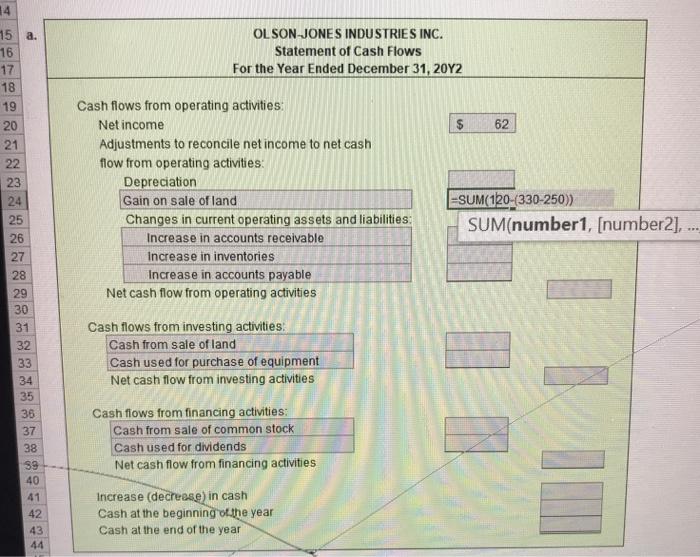

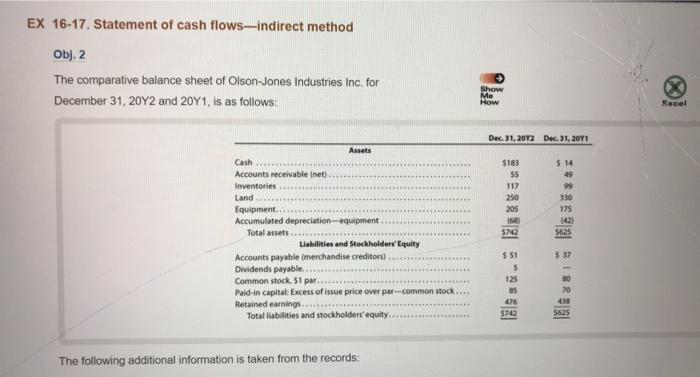

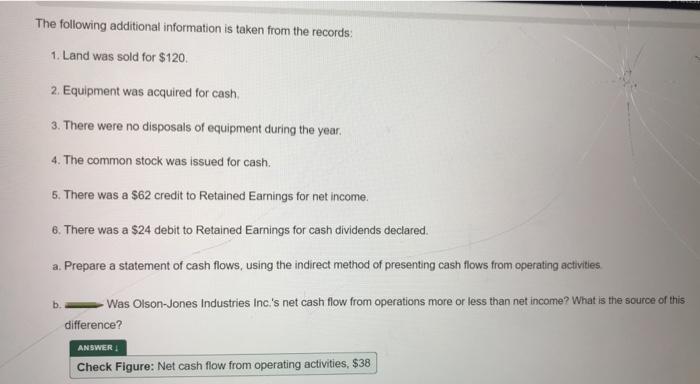

14 15 a. 16 17 18 OL SON-JONES INDUSTRIES INC. Statement of Cash Flows For the Year Ended December 31, 20Y2 19 62 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of land Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Increase in accounts payable Net cash flow from operating activities 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 38 37 = SUM(120-330-250) SUM(number1, [number2], ... Cash flows from investing activities: Cash from sale of land Cash used for purchase of equipment Net cash flow from investing activities Cash flows from financing activities: Cash from sale of common stock Cash used for dividends Net cash flow from financing activities 38 99 40 41 42 43 44 Increase (decrease in cash Cash at the beginning of the year Cash at the end of the year EX 16-17. Statement of cash flows-indirect method Obj. 2 The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 2041, is as follows: Show Me How Srcel Dec 31, 2012 Dec 31, 2011 Assets Cash Accounts receivable (net) Inventories Land Equipment. Accumulated depreciation equipment Total assets Liabilities and Stockholders' Equity Accounts payable merchandise creditors) Dividends payable Common stock, 51 par... Paid-in capital: Excess of issue price over par--common stock.... Retained earnings. Total liabilities and stockholders'equity $183 55 117 250 205 16 5742 5 14 49 99 330 175 (421 5625 $ 51 5 125 BS 80 70 5742 $625 The following additional information is taken from the records: The following additional information is taken from the records: 1. Land was sold for $120. 2. Equipment was acquired for cash 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $62 credit to Retained Earnings for net income. 6. There was a $24 debit to Retained Earnings for cash dividends declared. a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities Was Olson-Jones Industries Inc.'s net cash flow from operations more or less than net income? What is the source of this difference? ANSWER Check Figure: Net cash flow from operating activities, $38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts