Question: answer explained please! thank you! deo) McGill and Smyth have capital balances on January 1 of $48,000 and $30,000, respectively. The partnership income sharing agreement

answer explained please! thank you!

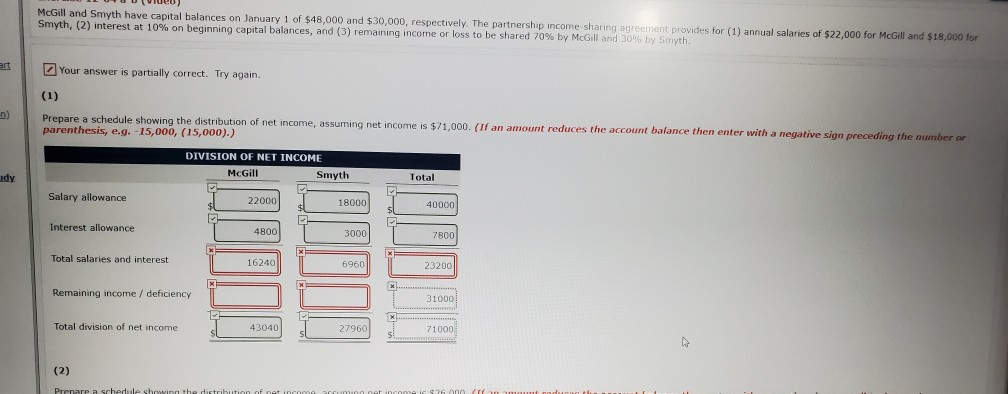

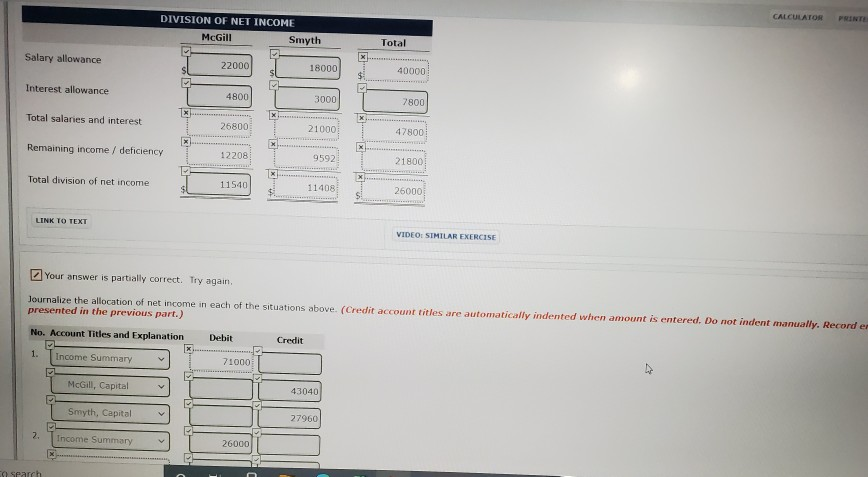

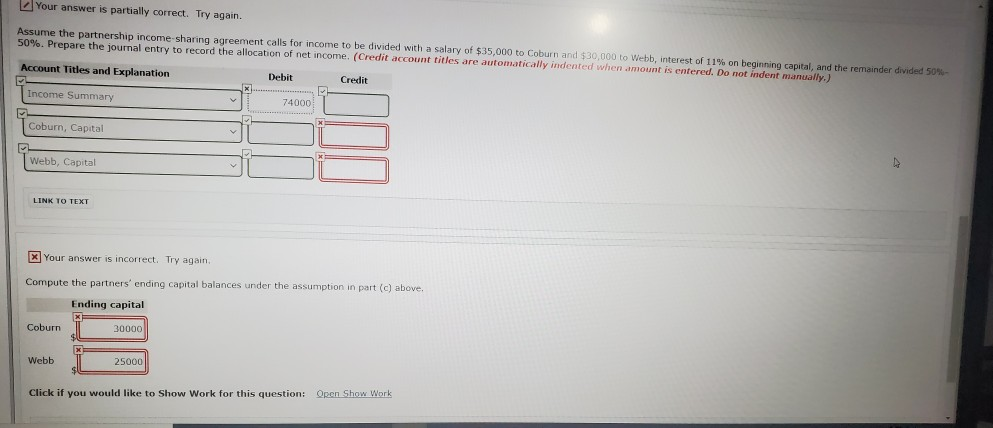

deo) McGill and Smyth have capital balances on January 1 of $48,000 and $30,000, respectively. The partnership income sharing agreement provides for (1) annual salaries of $22,000 for McGill and $18,000 for Smyth, (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shared 70% by McGill and 30% by Smyth Your answer is partially correct. Try again. (1) Prepare a schedule showing the distribution of net income, assuming net income is $71,000. (If an amount reduces the account balance then enter with a negative sign preceding the number or parenthesis, e.g. - 15,000, (15,000).) DIVISION OF NET INCOME McGill Smyth dy Total Salary allowance 22000 18000 40000 Interest allowance 4800 3000 7800 x Total salaries and interest 16240 6960 23200 x Remaining income / deficiency 31000 Total division of net income 43040 27960 71000 (2) Prenare a schedule CALCULATOR DIVISION OF NET INCOME McGill Smyth Total Salary allowance 22000 su 18000 40000 $ Interest allowance 4800 3000 7800 Total salaries and interest X 25800 21000 47800 Remaining income / deficiency 12208 9592 21800 Total division of net income 11540 $ 11408 26000 LINK TO TEXT VIDEO: SIMILAR EXERCISE Your answer is partially correct. Try again. Journalize the allocation of net income in each of the situations above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Recorder presented in the previous part.) No. Account Titles and Explanation Debit Credit 1. Income Summary 71000 McGill, Capital 43040 Smyth, Capital 27960 2. Income Summary 26000 Search Your answer is partially correct. Try again. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $35,000 to Coburn and $30,000 to Webb, interest of 11% on 50%. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented whenomenerite ceste red. Woonbedring capital, and the remainder divided 50% Account Titles and Explanation Credit Debit Income Summary 74000 Coburn, Capital Webb, Capital X LINK TO TEXT x Your answer is incorrect. Try again Compute the partners' ending capital balances under the assumption in part (c) above. Ending capital x Coburn 30000 Webb 25000 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts