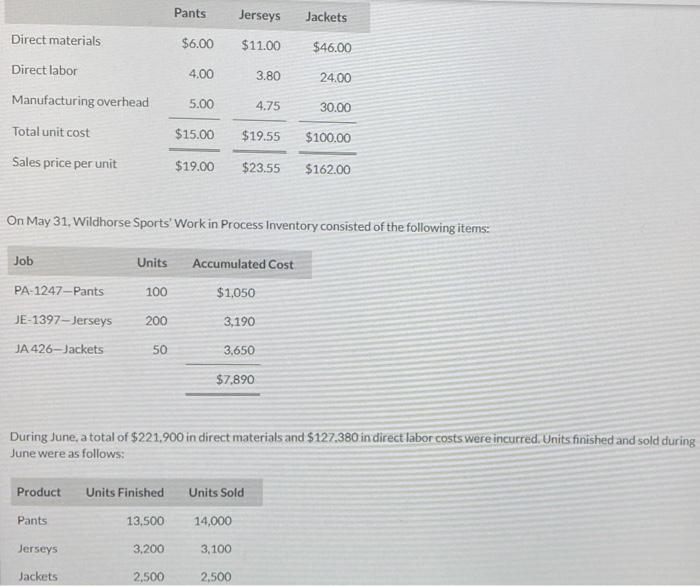

Question: answer F for thumbs up Pants Jerseys Jackets Direct materials $6.00 $11.00 $46.00 Direct labor 4.00 3.80 24.00 Manufacturing overhead 5.00 4.75 30.00 Total unit

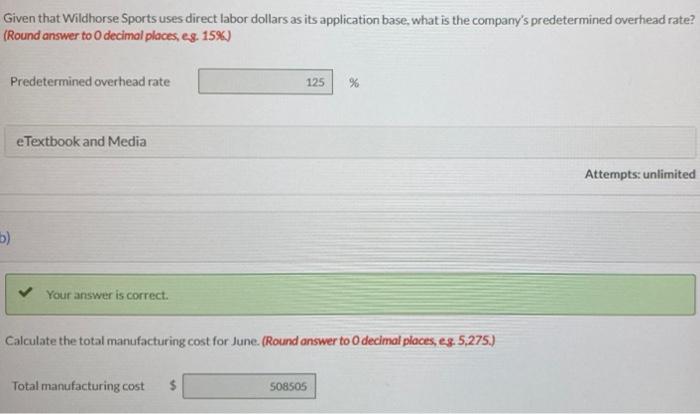

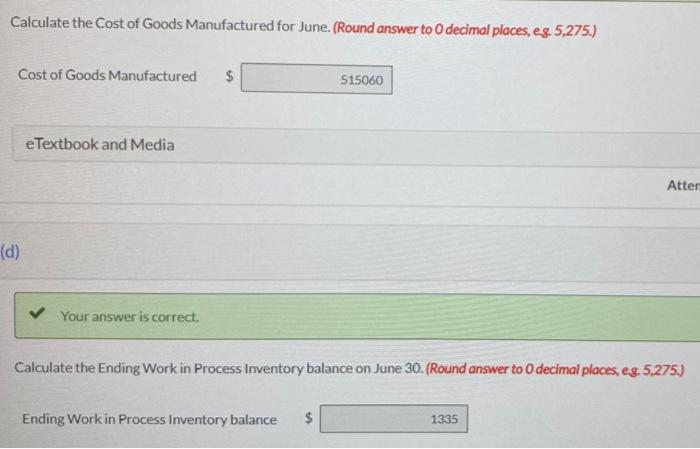

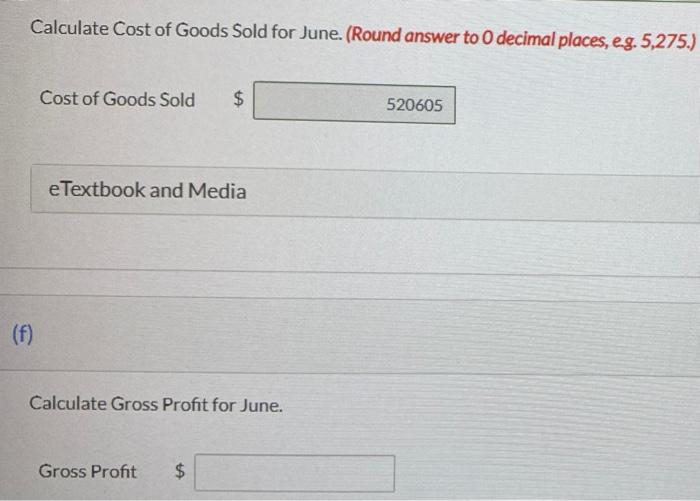

Pants Jerseys Jackets Direct materials $6.00 $11.00 $46.00 Direct labor 4.00 3.80 24.00 Manufacturing overhead 5.00 4.75 30.00 Total unit cost $15.00 $19.55 $100.00 Sales price per unit $19.00 $23.55 $162.00 On May 31, Wildhorse Sports' Work in Process Inventory consisted of the following items: Job Units Accumulated Cost PA-1247-Pants 100 $1,050 JE-1397-Jerseys 200 3,190 JA 426-Jackets 50 3,650 $7,890 During June, a total of $221,900 in direct materials and $127.380 in direct labor costs were incurred. Units finished and sold during June were as follows: Product Units Finished Units Sold Pants 13,500 14,000 Jerseys 3,200 3,100 Jackets 2,500 2,500 Given that Wildhorse Sports uses direct labor dollars as its application base, what is the company's predetermined overhead rate? (Round answer to O decimal places, e.g. 15%) Predetermined overhead rate 125 % eTextbook and Media Attempts: unlimited Your answer is correct. Calculate the total manufacturing cost for June. (Round answer to 0 decimal places, eg. 5,275.) Total manufacturing cost 508505 b) Calculate the Cost of Goods Manufactured for June. (Round answer to O decimal places, eg. 5,275.) Cost of Goods Manufactured $ 515060 eTextbook and Media Atter Your answer is correct. Calculate the Ending Work in Process Inventory balance on June 30. (Round answer to 0 decimal places, eg. 5,275.) Ending Work in Process Inventory balance $ 1335 (d) Calculate Cost of Goods Sold for June. (Round answer to 0 decimal places, e.g. 5,275.) Cost of Goods Sold $ 520605 eTextbook and Media (f) Calculate Gross Profit for June. Gross Profit $ tA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts