Question: ANSWER FAST PLEASE. ROUND YOUR ANSWER TO TWO DECIMAL PLACES. Question 14 5 pts One year ago, an investor purchased a 10-year 8% annual coupon

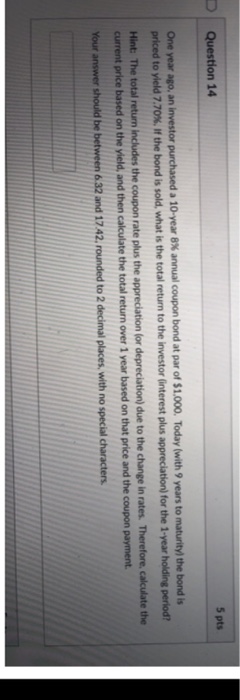

Question 14 5 pts One year ago, an investor purchased a 10-year 8% annual coupon bond at par of $1,000. Today (with 9 years to maturity, the bond is priced to yield 7.70% If the bond is sold, what is the total return to the investor (interest plus appreciation) for the 1-year holding period? Hint The total returm ncduodes the coupon rate pus the appreciation or depreciuation) due to the change in rates Theretore, caleudate the current price based on the yield, and then calculate the total return over 1 year based on that price and the coupon payment Your answer should be between 6.32 and 1742,rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts