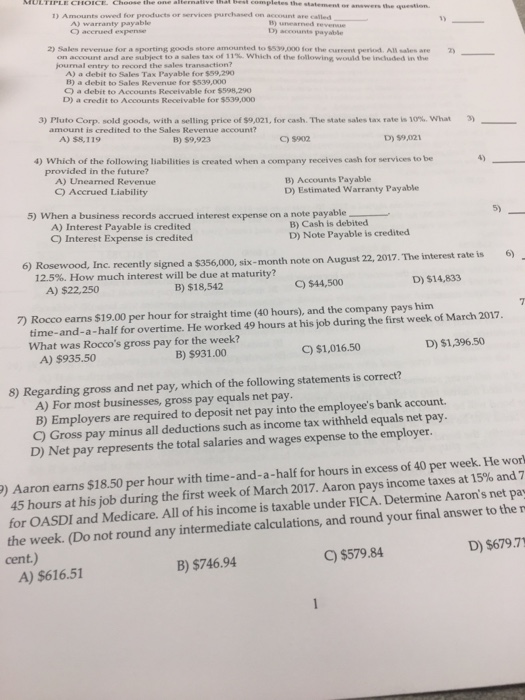

Question: Answer fast please the statement or answers the 1) Amounts owed for products or services purchased on account are called question A) warranty payable O

the statement or answers the 1) Amounts owed for products or services purchased on account are called question A) warranty payable O acenued expense D) accounts payable 2) Sales revenue for a sporting goods store amounted to $539,000 for the current period. y on account and are subject to a sales tax of 11%, which of the f jourmal entry to record the sales transaction? All sales are be included in the llowing would A) a debit to Sales Tax Payable for $59,290 B) a debit to Sales Revenue for $539,000 ) a debit to Accounts Receivable for $598,290 D) a credit to Accounts Receivable for $539,000 3) Pluto Corp. sold goods, with a selling price of S9,021, for cash. The state sales tax rate is 10%, what amount is credited to the Sales Revenue account? ) A) $8,119 B) $9,923 D) $9,021 4) Which of the following liabilities is created when a company receives cash for services to be provided in the future? 4) A) Uneaned Revenue C) Accrued Liability B) Accounts Payable D) Estimated Warranty Payable 5) When a business records accrued interest expense on a note payable 5 A) Interest Payable is credited C) Interest Expense is credited B) Cash is debited D) Note Payable is credited 6) Rosewood, Inc. recently signed a $356,000, six-month note on August 22, 2017. The interest rate is 6 12.5%. How much interest will be due at maturity? A) $22,250 B) $18,542 C) $44,500 D) $14,833 7) Rocco earns $19.00 per hour for straight time (40 hours), and the company pays him time-and-a-half for overtime. He worked 49 hours at his job during the first week of March 2017. What was Rocco's gross pay for the week? C) $1,016.50 D) $1,396.50 A) $935.50 B) $931.00 8) Regarding gross and net pay, which of the following statements is correct? A) For most businesses, gross pay equals net pay. B) Employers are required to deposit net pay into the employee's bank account. C) Gross pay minus all deductions such as income tax withheld equals net pay. D) Net pay represents the total salaries and wages expense to the employer 9) Aaron earns $18.50 per hour with time-and-a-half for hours in excess of 40 per week. He wor 45 hours at his job during the first week of March 2017. Aaron pays income taxes at 15% and 7 for OASDI and Medicare. All of his income is taxable under FICA. Determine Aaron's net pa the week. (Do not round any intermediate calculations, and round your final answer to the cent.) D) $679.7 C) $579.84 A) $616.51 B) $746.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts