Question: Answer filling the chart with the instructions and explan the purpose of the problem,, the theory of techniques , and interpretation of results Chapter 5

Answer filling the chart with the instructions and explan the purpose of the problem,, the theory of techniques , and interpretation of results

Answer filling the chart with the instructions and explan the purpose of the problem,, the theory of techniques , and interpretation of results

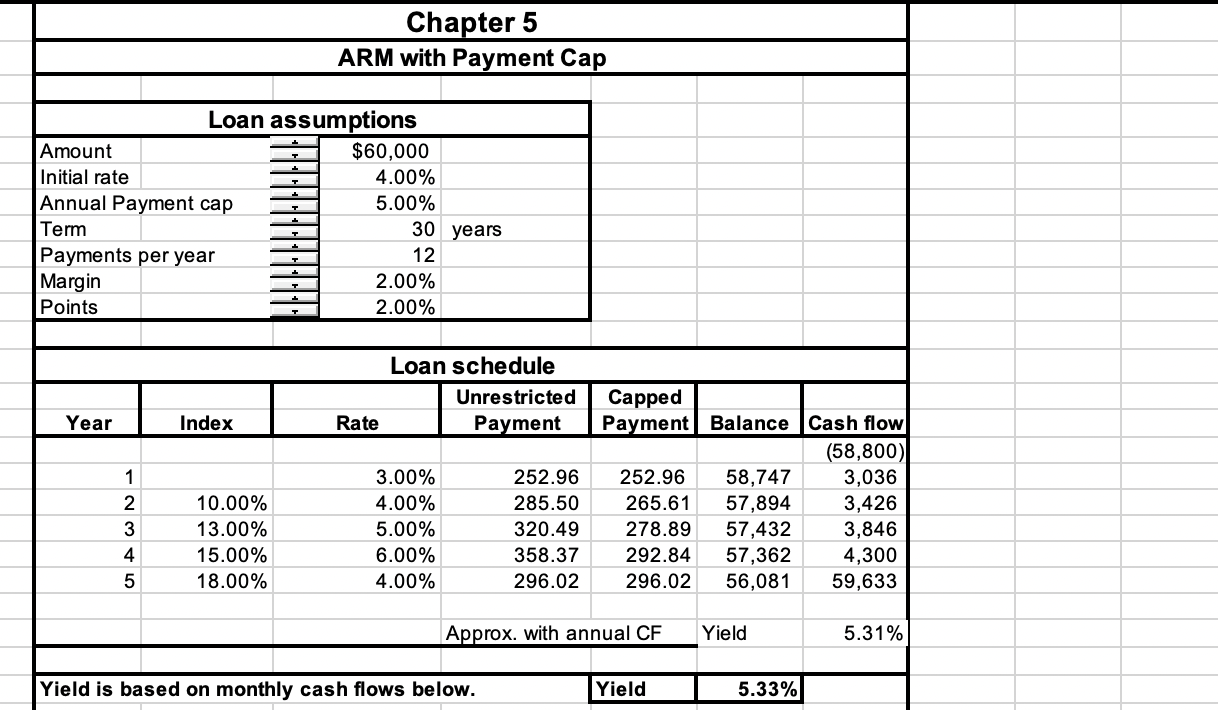

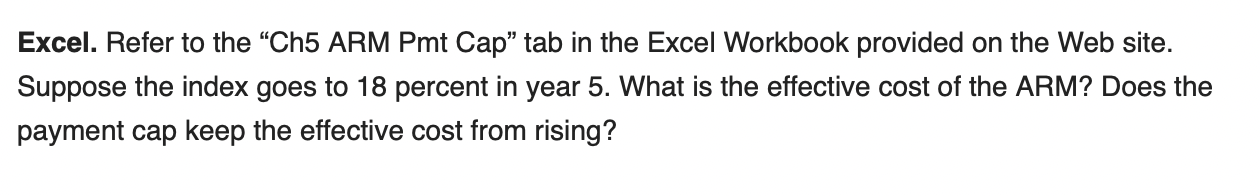

Chapter 5 ARM with Payment Cap Loan assumptions Amount $60,000 Initial rate 4.00% Annual Payment cap 5.00% Term Payments per year 12 Margin 2.00% Points 2.00% 30 years Loan schedule Unrestricted Payment Year Index Rate 1 2 3 4 5 3.00% 4.00% 5.00% 6.00% 4.00% 10.00% 13.00% 15.00% 18.00% Capped Payment Balance Cash flow (58,800) 252.96 58,747 3,036 265.61 57,894 3,426 278.89 57,432 3,846 292.84 57,362 4,300 296.02 56,081 59,633 252.96 285.50 320.49 358.37 296.02 Approx. with annual CF Yield 5.31% Yield is based on monthly cash flows below. Yield 5.33% Excel. Refer to the "Ch5 ARM Pmt Cap tab in the Excel Workbook provided on the Web site. Suppose the index goes to 18 percent in year 5. What is the effective cost of the ARM? Does the payment cap keep the effective cost from rising? Chapter 5 ARM with Payment Cap Loan assumptions Amount $60,000 Initial rate 4.00% Annual Payment cap 5.00% Term Payments per year 12 Margin 2.00% Points 2.00% 30 years Loan schedule Unrestricted Payment Year Index Rate 1 2 3 4 5 3.00% 4.00% 5.00% 6.00% 4.00% 10.00% 13.00% 15.00% 18.00% Capped Payment Balance Cash flow (58,800) 252.96 58,747 3,036 265.61 57,894 3,426 278.89 57,432 3,846 292.84 57,362 4,300 296.02 56,081 59,633 252.96 285.50 320.49 358.37 296.02 Approx. with annual CF Yield 5.31% Yield is based on monthly cash flows below. Yield 5.33% Excel. Refer to the "Ch5 ARM Pmt Cap tab in the Excel Workbook provided on the Web site. Suppose the index goes to 18 percent in year 5. What is the effective cost of the ARM? Does the payment cap keep the effective cost from rising

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts