Question: Answer follow image Emergency. Don,t use excel. Do calculation Brandy Clark, CFA, has forecast that Aceler, Inc., will pay its first dividend two years from

Answer follow image

Emergency. Don,t use excel. Do calculation

Emergency. Don,t use excel. Do calculation

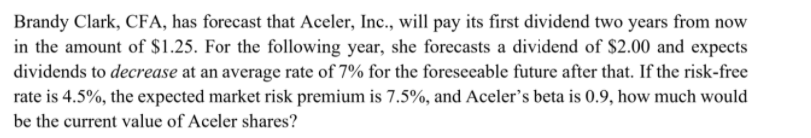

Brandy Clark, CFA, has forecast that Aceler, Inc., will pay its first dividend two years from now in the amount of $1.25. For the following year, she forecasts a dividend of $2.00 and expects dividends to decrease at an average rate of 7% for the foreseeable future after that. If the risk-free rate is 4.5%, the expected market risk premium is 7.5%, and Aceler's beta is 0.9, how much would be the current value of Aceler shares

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock