Question: Answer following analysis questions a thumbs up will be given 1. The real benefit will come from increased revenue realization from the rotary meter .

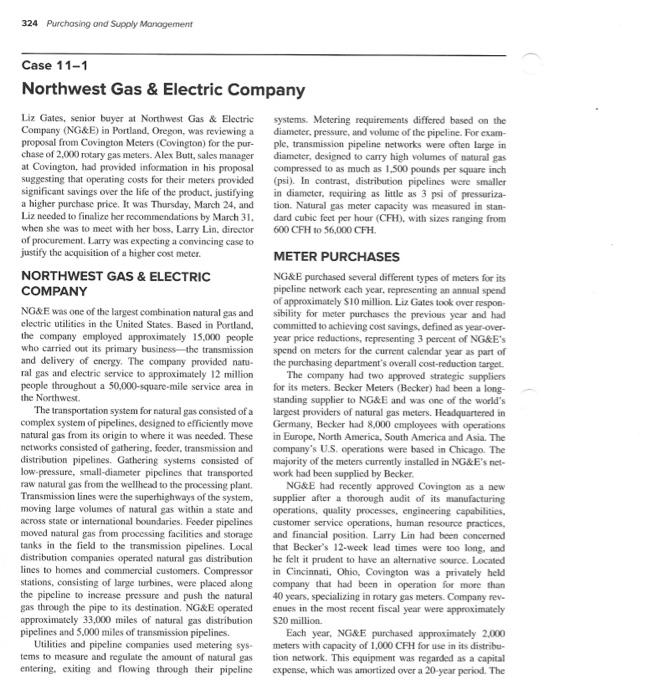

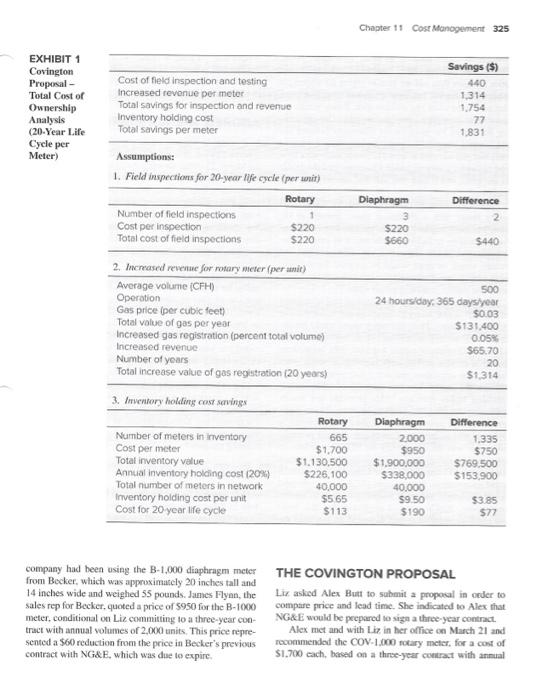

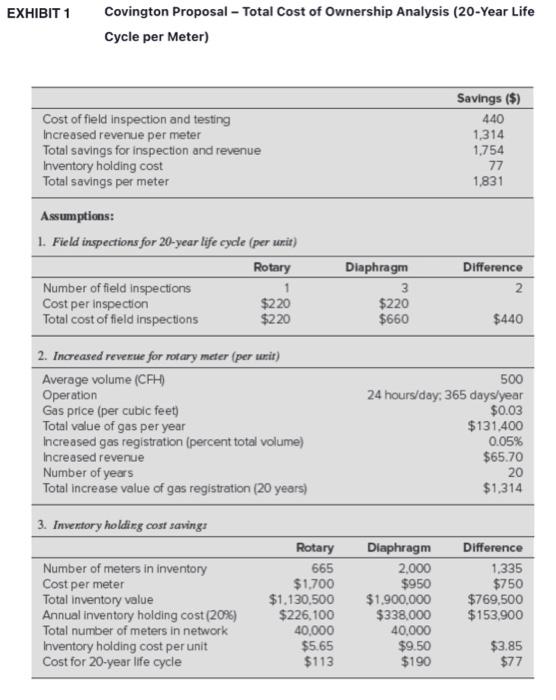

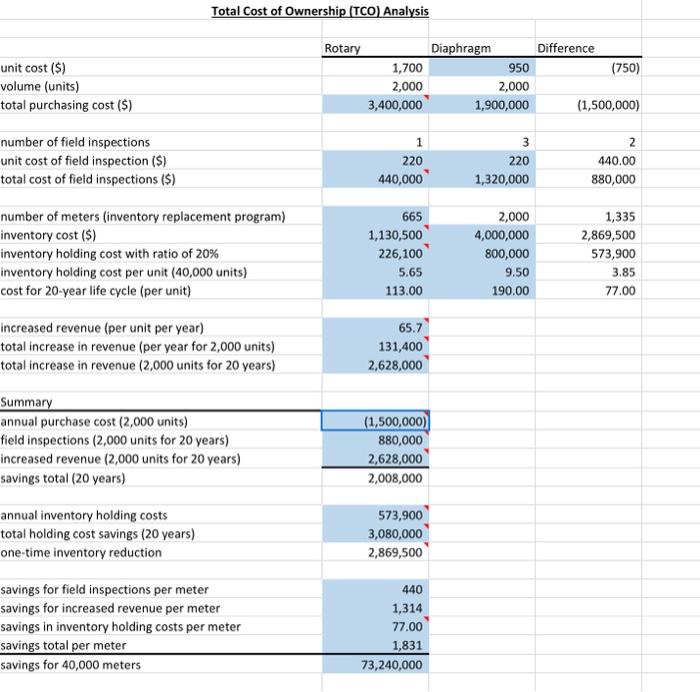

Liz Gates, senior buyer at Northwest Gas \& Electric systems. Mctering requirements differed based on the Company (NG\&E) in Portland, Oregon, was reviewing a diameter, pressure, and volume of the pipeline. For examproposal from Covington Meters (Covington) for the pur- ple, transmission pipeline networks were often large in chase of 2,000 rotary gas meters. Alex Butt, sales manager diameter, dexigned to carry high volumes of natural gas at Covington, had provided information in his proposal compressed to as much as 1,500 pounds per square inch suggesting that operating costs for their meters provided (psi). In contrast, distribution pipelines were smaller significant savings over the life of the product, justifying in diameter, requiring as little as 3 psi of pressurizaa higher purchase price. It was Thursday, March 24 , and tion. Natural gas meter eapacity was measured in stanLiz needed to finalize her recommendations by March 31. dard cubic feet per hour (CFH), with sizes ranging from when she was to meet with her boss, Larry Lin, director 600CFH to 56,000CFH. of procurement. Larry was expecting a convincing case to justify the acquisition of a higher cost meter. METER PURCHASES NORTHWEST GAS \& ELECTRIC NG\&E purchased several different types of meters for its COMPANY pipeline network each year, representing an annual spend NGEE was one of the laryest eombination naturat of approximately $10 million. Liz Gates took over responclectric utilitics in the United States. Based in Pas and sibility for meter purchases the previous year and had the company employed approximstely 15 omortland. committed to achieving cost savings, definod as year-overwho carried out its pro approximately 15,000 people year price reductionk, representing 3 perceat of NG\&E's and delivery of e primary business- the transmission spend on meters for the current calendar year as part of and delivery of energy. The company provided natu- the purchasing department's overall cost-reduction target. rat gas and electric service to approximately 12 million The company had two approved strategic suppliers people throughout a 50,000 -square-mile service area in for its meters. Becker Meters (Becker) had been a longthe Northwed. standing supplier to NGEE and was one of the world's The transportation system for natural gas consisted of a largest providers of natural gas meters. Headquartered in complex system of pipelines, designed to efficiently move Germany, Becker had 8,000 cmployees with operations natural gas from its origin to where it was needed. These in Europe. North America, South America and Asia. The networks consisted of gathering. foeder, transmission and company's U.S. operations were based in Chicago. The distribution pipetines. Gathering systems consisted of majority of the meters currently installed in NGEE's netlow-pressure, small-diameter pipelines that transported work had been supplied by Becker. raw natural gas from the wellhead to the processing plant. NG\&E had recently approved Covingion as a aew Transmission lines were the saperhighways of the system, supplier after a thorough audit of its manufacturing moving large volumes of natural gas within a state and operations, quality processes, engineering capabilities, across state or international boundaries. Feeder pipelines customer service operations, buman resource practices, moved natural gas from processing facilities and storage and financial position. Larry Lin had been concemed tanks in the fiek to the transmission pipelines. Local that Becker's 12-week lead times were too long, and distribution companies operated natural gas distribution he felt it prudent to have an allernative wource. Located lines to homes and commercial customers. Compressor in Cincinnati, Ohio, Covington was a privalely held stations, consisting of large turbines, were placed along company that had been in operation for more than the pipeline to increase pressure and push the natural 40 years, specializing in rotary gas meters. Company revgas through the pipe to its destination. NG\&E operated enues in the most recent fiscal year were approximately approximately 33,000 miles of natural gas distribution $20 million. pipelines and 5.000 miles of transmission pipelines. Each year, NG\&E purchased approximately 2.000 Utilities and pipeline companies used metering sys- meters with capacity of 1,000CFH for use in its distribttems to measure and regulate the amount of natural gas tion network. This equipment was regarded as a capital entering. exiting and flowing through their pipeline expense, which was amortized over a 20-year period. The Chapter 11 Cosr Manogement 325 EXHIBIT 1 Covington Proposal - Total Cost of Ownership Analysis (20-Year Life Cycle per Meter) Assumptions: 1. Field inspectious for 20-year llfe cycle (per iouit) company had been using the B-1,000 diaphragm meter THE COVINGTON PROPOSAL from Becker, which was appoximately 20 inches tall and 14 inches wide and weighed 55 pounds. James Flyan, the Lir ashed Alex Butt to submit a propocal in oeder to sales rep for Becker, quoted a price of 5950 for the B-1000 compare price and lead time. She indicated to Alex that meter, conditional on Liz comniting to a three-year con- NGde would be peepared lo sigan a three-year contract. tract with annual volumes of 2,000 units. This price repre- Alex met and with L iz in ber office on March 21 and sented a $60 reduction from the price in Becker's previous rocommendod the COV-1.000 notary meter, for a cost of contract with NGdE, which was due to expire. $1,700 each, based on a thrse-year coutract with annual IBIT 1 Covington Proposal - Total Cost of Ownership Analysis (20-Year Life Cycle per Meter) volumes of 2,000 units. Lead times were eight weeks. weight and 70 percent reduction in size compared to During the meeting. Alex commented: "I expect our the B-1,000, allowing for easier and safer handling and price is higher than you are used to paying for diaphragm installation. A summary of the analysis provided by Alex meters from Becker, bet there are factors other than price in his proposal is in Exhibit 1. that need to be taken into consideration. Rotary meters are more durable, requiring less maintenance. Our engineering department has analyzed the differences between our ANDREW SPENCE MEETING product and comparabie diaphragm meters, and we esti- In preparation for her meeting with Larry, Liz visited mate that you can save at least $1,700 per meter on a total Andrew Spence, director of field maintenance at NGiEE, cost basis over a 20-year period. I have provided the details on March 23. After showing Andrew the proposal from in the quote, and I think you will find our proposal very Alex Butt, he commented: "We do service our diaphragm attractive." meters on a five- to seven-year cycle, depending on the The Covington proposal included its COV-1,000 level of use and manufacturer specifications. Most require rotary meter with a diaphragm meter conversion kit, routine maintenance and a proof test to ensure accuracy. complete with required piping, gaskets and bolts, and We check for internal friction, leaks, and diaphragm the instructions to facilitate replacement of existing dia- displacement. Rotary meters are definitely sturdier. The phragm meters. The conversion kits were pre-sized and pressure bodies are good for 20 years or more. but the factory tested, so there would be no need for welding. clectronics need to be checked every 10 or 11 years. It pipe cutting, and other extensive labor. Installation costs is expensive for technicians drive to the site to remove a would be similar to the diaphragm meter. meter for testing and swap in a replacement meter. The The proposal from Alex indicated several advantages amount of time required depends on the location and of the COV-1,000 rotary meter compared to comparable travel time. Ideally we combine maintenance activities diaphragm meters. First, the rotary meter would require or batch the inspections and do all the meters at a site at fewer field service inspections, at an interval of every one time. The $220 estimate per meter is likely close pro11 years. Diaphragm meters required three inspections vided you want to include costs for technician labor, use during a 20-year period, with intervals of seven years of the vehicle and equipment, parts, and administrative for the first inspection and every five years thereafter. costs. Keep in mind that our technicians have been serSecond, the higher flow-rate accuracy of rotary meters vicing and installing diaphragm meters exclusively for as provided higher revenues. Alex provided test results long as I remember. A switch to rotary meters will be seen indicating that the COV-1,000 meter increased gas regis- as a big change, and there will be lots of questions from tration by 0.05 percent, which resulted in approximately the technicians. Keep me posted on what happens. If we $66 per year in additional revenues. A third potential change to the Covington product, I will noed to arrange advantage was the opportunity for NG\&E to reduce its training sessions." inventory of meters used as replacements when meters were removed from the field for inspections in order to avoid interruptions in operations. NG\&E currently held COMPARING OPTIONS 2,000 diaphragm meters in inventory to support service As Liz prepared for her meeting with Larry, she wondered inspections. Alex's proposal suggested that this num- how to balance the potential long-term cost efficiencies ber could be reduced to 665 meters if NG\&E used the of the Covington meter with the lower cost of the Becker COV-1,000 rotary meter in its pipeline network. Lastly. product. She was all too aware that Larry was expecting to the Covington meter offered a 50 percent reduction in see price reductions in meter purchases this year. Total Cost of Ownership (TCO) Analysis \begin{tabular}{lr|r|r|} \hline number of field inspections & 1 & 3 & 2 \\ \hline unit cost of field inspection (\$) & 220 & 220 & 440.00 \\ \hline total cost of field inspections (\$) & 440,000 & 1,320,000 & 880,000 \\ \hline \end{tabular} \begin{tabular}{lrr|r|} number of meters (inventory replacement program) & 665 & 2,000 & 1,335 \\ inventory cost (\$) & 1,130,500 & 4,000,000 & 2,869,500 \\ \hline inventory holding cost with ratio of 20% & 226,100 & 800,000 & 573,900 \\ inventory holding cost per unit (40,000 units) & 5.65 & 9.50 & 3.85 \\ \hline cost for 20-year life cycle (per unit) & 113.00 & 190.00 & 77.00 \\ \hline \end{tabular} increasedrevenue(perunitperyear)totalincreaseinrevenue(peryearfor2,000units)totalincreaseinrevenue(2,000unitsfor20years)65.7131,4002,628,000 Summary \begin{tabular}{lr} \hline annual purchase cost (2,000 units) & (1,500,000) \\ \hline field inspections ( 2,000 units for 20 years) & 880,000 \\ increased revenue ( 2,000 units for 20 years) & 2,628,000 \\ \hline savings total (20 years) & 2,008,000 \end{tabular} annual inventory holding costs total holding cost savings ( 20 years) one-time inventory reduction savings for field inspections per meter savings for increased revenue per meter savings in inventory holding costs per meter savings total per meter savings for 40,000 meters 73,240,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts