Question: Answer for #5 on 2nd image 5. (2pts) Using the following returns, calculate the arithmetic average return, the variance, and the standard deviation Interpret your

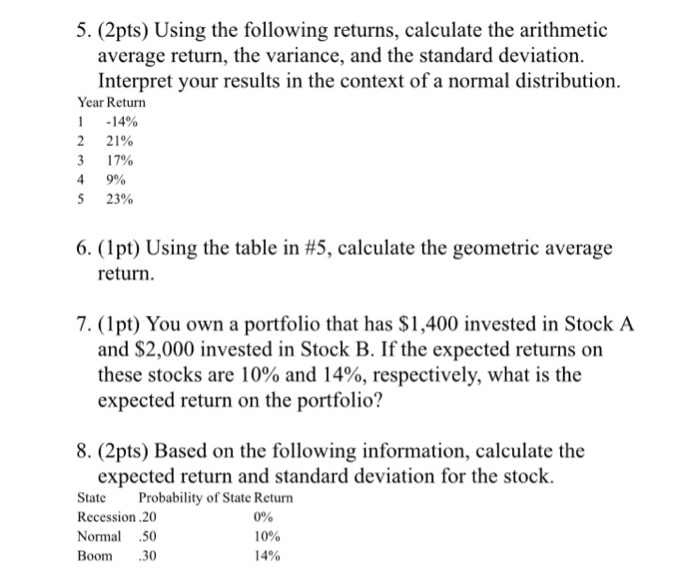

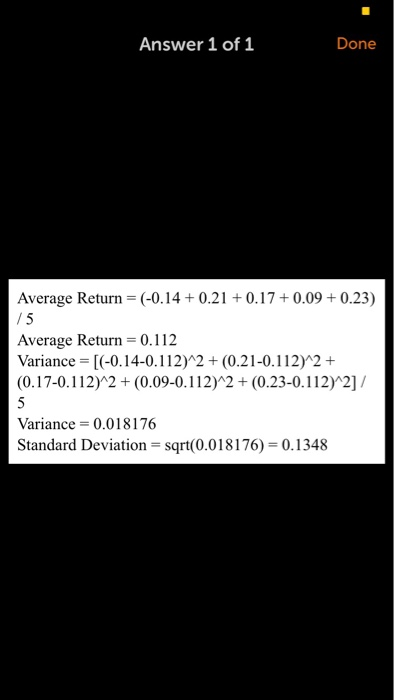

5. (2pts) Using the following returns, calculate the arithmetic average return, the variance, and the standard deviation Interpret your results in the context of a normal distribution Year Return -14% 2 21% 317% 49% 5 23% 6. ( 1 pt) Using the table in #5, calculate the geometric average return 7. (1pt) You own a portfolio that has $1,400 invested in Stock A and $2,000 invested in Stock B. If the expected returns on these stocks are 10% and 14%, respectively, what is the expected return on the portfolio? 8. (2pts) Based on the following information, calculate the expected return and standard deviation for the stock. State Probability of State Return Recession.20 Normal 50 Boom 30 0% 10% Answer 1 of 1 Done Average Return (-0.14 + 0.210.17+0.09+0.23) /5 Average Return 0.112 Variance (-0.14-0.112)2 (0.21-0.112) 2+ (0.17-0.112)12 (0.09-0.12)2+ (0.23-0.112)2]/ Variance- 0.018176 Standard Deviation sqrt(0.018176) 0.1348

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts