Question: Answer for part b should be $0.88 with 13.6% as rate of return. 2) Consider a two-period economy in which an individual has a utility

Answer for part b should be $0.88 with 13.6% as rate of return.

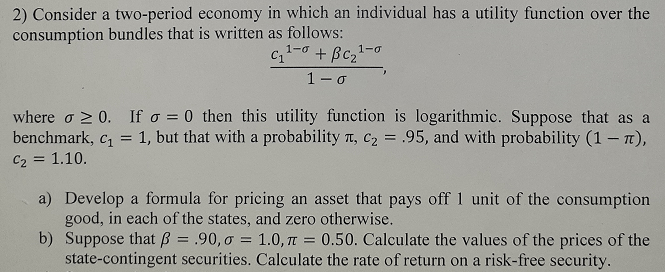

2) Consider a two-period economy in which an individual has a utility function over the consumption bundles that is written as follows: C11-6 + Bc21 1-0 1-0 where o 20. If o = 0 then this utility function is logarithmic. Suppose that as a benchmark, C1 = 1, but that with a probability , C2 = .95, and with probability (1 t), C2 = 1.10. a) Develop a formula for pricing an asset that pays off 1 unit of the consumption good, in each of the states, and zero otherwise. b) Suppose that B = .90,0 = 1.0, = 0.50. Calculate the values of the prices of the state-contingent securities. Calculate the rate of return on a risk-free security. 2) Consider a two-period economy in which an individual has a utility function over the consumption bundles that is written as follows: C11-6 + Bc21 1-0 1-0 where o 20. If o = 0 then this utility function is logarithmic. Suppose that as a benchmark, C1 = 1, but that with a probability , C2 = .95, and with probability (1 t), C2 = 1.10. a) Develop a formula for pricing an asset that pays off 1 unit of the consumption good, in each of the states, and zero otherwise. b) Suppose that B = .90,0 = 1.0, = 0.50. Calculate the values of the prices of the state-contingent securities. Calculate the rate of return on a risk-free security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts