Question: answer for the questions I got wrong Required information Covey Company purchased a machine on January 1, 2022, by paying cash of $270,000. The machine

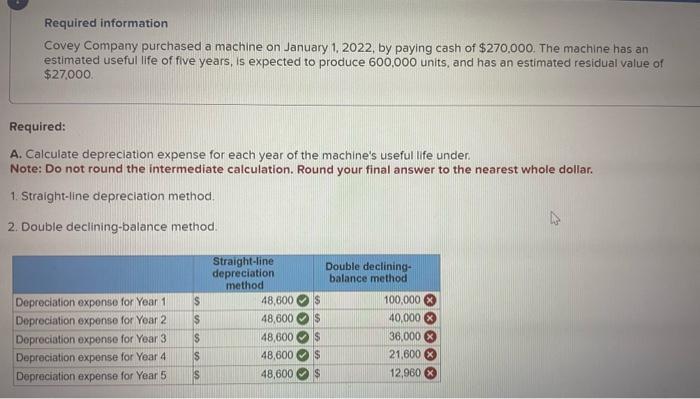

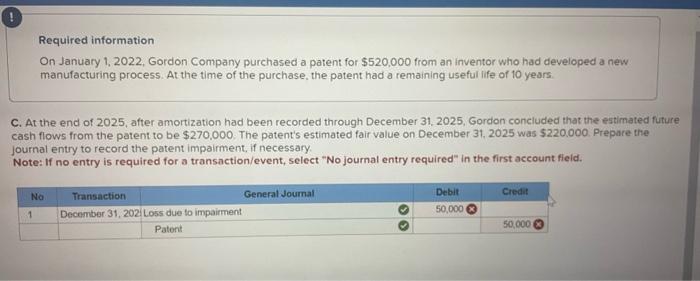

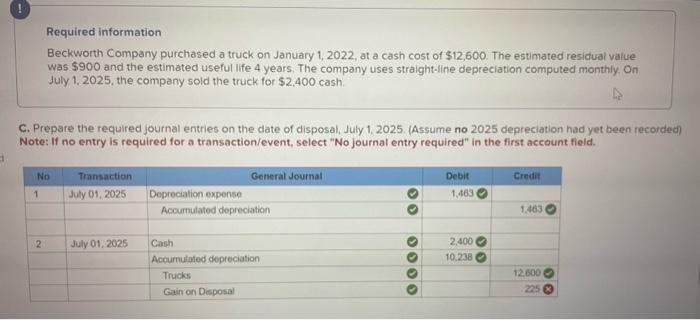

Required information Covey Company purchased a machine on January 1, 2022, by paying cash of $270,000. The machine has an estimated useful life of five years, is expected to produce 600,000 units, and has an estimated residual value of $27,000 Required: A. Calculate depreciation expense for each year of the machine's useful life under. Note: Do not round the intermediate calculation. Round your final answer to the nearest whole dollar. 1. Straight-line depreciation method. 2. Double declining-balance method. Required information On January 1, 2022, Gordon Company purchased a patent for $520,000 from an inventor who had developed a new manufacturing process. At the time of the purchase, the patent had a remaining useful life of 10 years. C. At the end of 2025, after amortization had been recorded through December 31, 2025, Gordon concluded that the estimated future cash flows from the patent to be $270,000. The patent's estimated fair value on December 31,2025 was $220.000. Prepare the journal entry to record the patent impairment, if necessary. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid. Required information Beckworth Company purchased a truck on January 1, 2022, at a cash cost of $12,600. The estimated residual value was $900 and the estimated useful life 4 years. The company uses straight-line depreciation computed monthly. On July 1, 2025, the company sold the truck for $2,400 cash. C. Prepare the required journal entries on the date of disposal, July 1, 2025. (Assume no 2025 depreciation had yet been recorded) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts