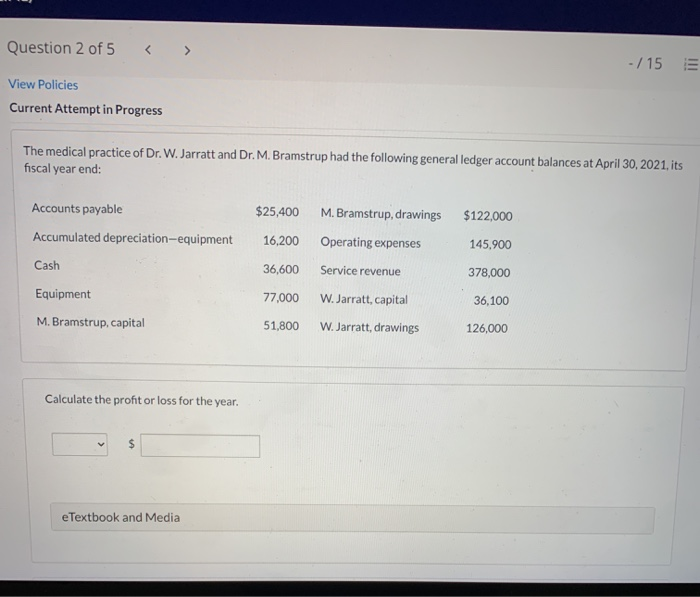

Question: Answer for this please Question 2 of 5 - / 15 View Policies Current Attempt in Progress The medical practice of Dr. W. Jarratt and

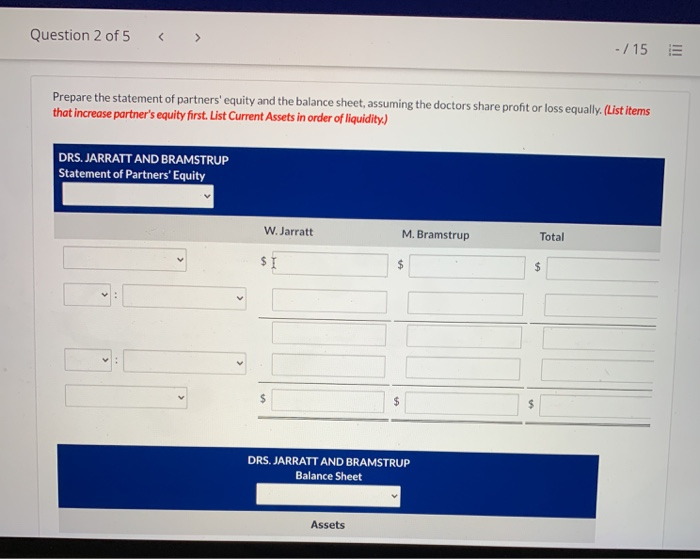

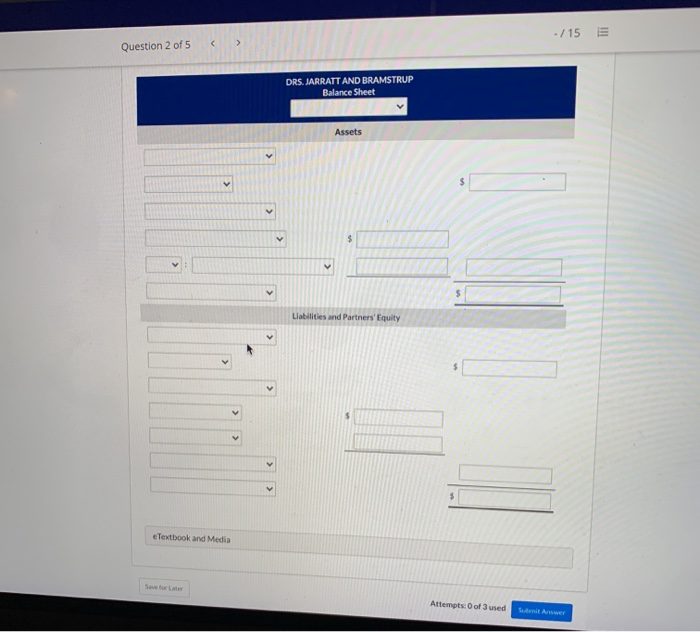

Question 2 of 5 - / 15 View Policies Current Attempt in Progress The medical practice of Dr. W. Jarratt and Dr. M. Bramstrup had the following general ledger account balances at April 30, 2021, its fiscal year end: Accounts payable $25,400 $122,000 Accumulated depreciation-equipment 16,200 145.900 M. Bramstrup, drawings Operating expenses Service revenue W. Jarratt, capital Cash 36,600 378,000 Equipment 77,000 36,100 M. Bramstrup, capital 51,800 W. Jarratt, drawings 126,000 Calculate the profit or loss for the year. e Textbook and Media Question 2 of 5 -/15 Prepare the statement of partners' equity and the balance sheet, assuming the doctors share profit or loss equally. (List items that increase partner's equity first. List Current Assets in order of liquidity.) DRS. JARRATT AND BRAMSTRUP Statement of Partners' Equity W. Jarratt M. Bramstrup Total $1 $ $ $ $ DRS. JARRATT AND BRAMSTRUP Balance Sheet Assets - / 15 E Question 2 of 5 DRS. JARRATT AND BRAMSTRUP Balance Sheet Assets $ V Liabilities and Partners' Equity e Textbook and Media Attempts of used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts