Question: answer for this show your solution thank you Case #5: Decision Analysis Shenna Nak has enjoyed sailing small boats since she was 7 years old,

answer for this show your solution thank you

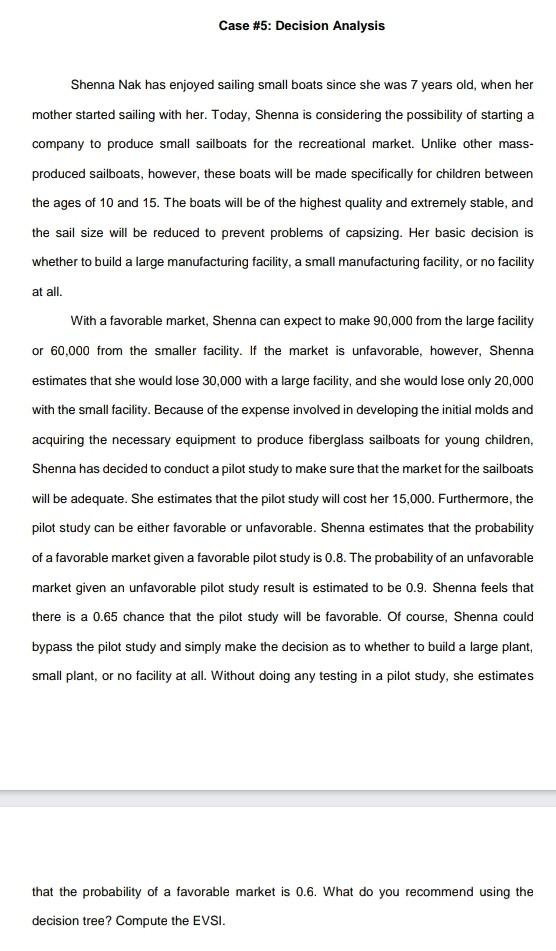

Case #5: Decision Analysis Shenna Nak has enjoyed sailing small boats since she was 7 years old, when her mother started sailing with her. Today, Shenna is considering the possibility of starting a company to produce small sailboats for the recreational market. Unlike other mass- produced sailboats, however, these boats will be made specifically for children between the ages of 10 and 15. The boats will be of the highest quality and extremely stable, and the sail size will be reduced to prevent problems of capsizing. Her basic decision is whether to build a large manufacturing facility, a small manufacturing facility, or no facility at all. With a favorable market, Shenna can expect to make 90,000 from the large facility or 60,000 from the smaller facility. If the market is unfavorable, however, Shenna estimates that she would lose 30,000 with a large facility, and she would lose only 20,000 with the small facility. Because of the expense involved in developing the initial molds and acquiring the necessary equipment to produce fiberglass sailboats for young children, Shenna has decided to conduct a pilot study to make sure that the market for the sailboats will be adequate. She estimates that the pilot study will cost her 15,000. Furthermore, the pilot study can be either favorable or unfavorable. Shenna estimates that the probability of a favorable market given a favorable pilot study is 0.8. The probability of an unfavorable market given an unfavorable pilot study result is estimated to be 0.9. Shenna feels that there is a 0.65 chance that the pilot study will be favorable. Of course, Shenna could bypass the pilot study and simply make the decision as to whether to build a large plant, small plant, or no facility at all. Without doing any testing in a pilot study, she estimates that the probability of a favorable market is 0.6. What do you recommend using the decision tree? Compute the EVSIStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock