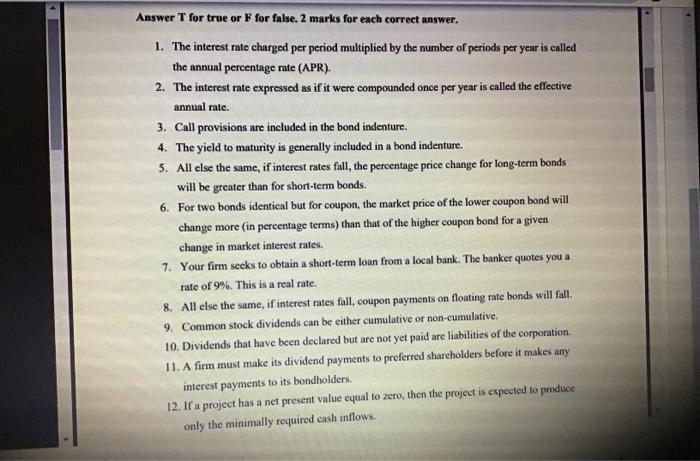

Question: Answer for true or F for false. 2 marks for each correct answer. 1. The interest rate charged per period multiplied by the number of

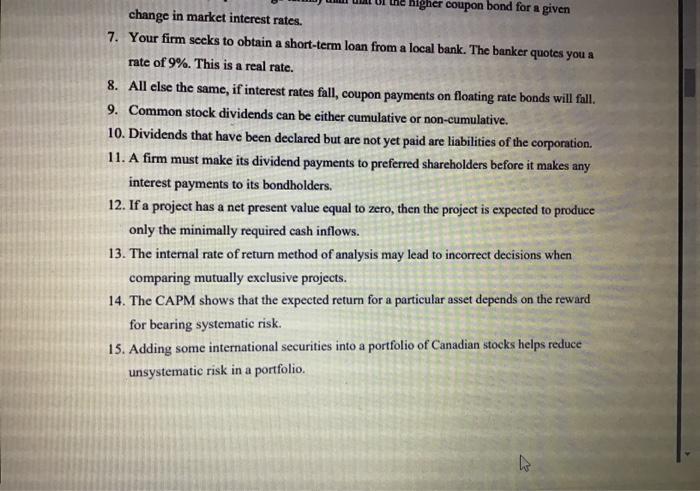

Answer for true or F for false. 2 marks for each correct answer. 1. The interest rate charged per period multiplied by the number of periods per year is called the annual percentage rate (APR). 2. The interest rate expressed as if it were compounded once per year is called the effective annual rate. 3. Call provisions are included in the bond indenture. 4. The yield to maturity is generally included in a bond indenture. 5. All else the same, if interest rates fall, the percentage price change for long-term bonds will be greater than for short-term bonds. 6. For two bonds identical but for coupon, the market price of the lower coupon bond will change more (in percentage terms) than that of the higher coupon bond for a given change in market interest rates. 7. Your firm seeks to obtain a short-term loan from a local bank. The banker quotes you a rate of 9%. This is a real rate. 8. All else the same, if interest rates fall, coupon payments on floating rate bonds will fall 9. Common stock dividends can be either cumulative or non-cumulative. 10. Dividends that have been declared but are not yet paid are liabilities of the corporation 11. A firm must make its dividend payments to preferred shareholders before it makes any interest payments to its bondholders. 12. If a project has a net present value equal to zero, then the project is expected to produce only the minimally required cash inflows. higher coupon bond for a given change in market interest rates. 7. Your firm seeks to obtain a short-term loan from a local bank. The banker quotes you a rate of 9%. This is a real rate. 8. All else the same, if interest rates fall, coupon payments on floating rate bonds will fall. 9. Common stock dividends can be either cumulative or non-cumulative. 10. Dividends that have been declared but are not yet paid are liabilities of the corporation. 11. A firm must make its dividend payments to preferred shareholders before it makes any interest payments to its bondholders. 12. If a project has a net present value equal to zero, then the project is expected to produce only the minimally required cash inflows. 13. The internal rate of return method of analysis may lead to incorrect decisions when comparing mutually exclusive projects. 14. The CAPM shows that the expected return for a particular asset depends on the reward for bearing systematic risk. 15. Adding some international securities into a portfolio of Canadian stocks helps reduce unsystematic risk in a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts