Question: Answer form below: Pinehurst County established a capital projects fund at the beginning of 2022 to construct a courthouse on land owned by the County.

Answer form below:

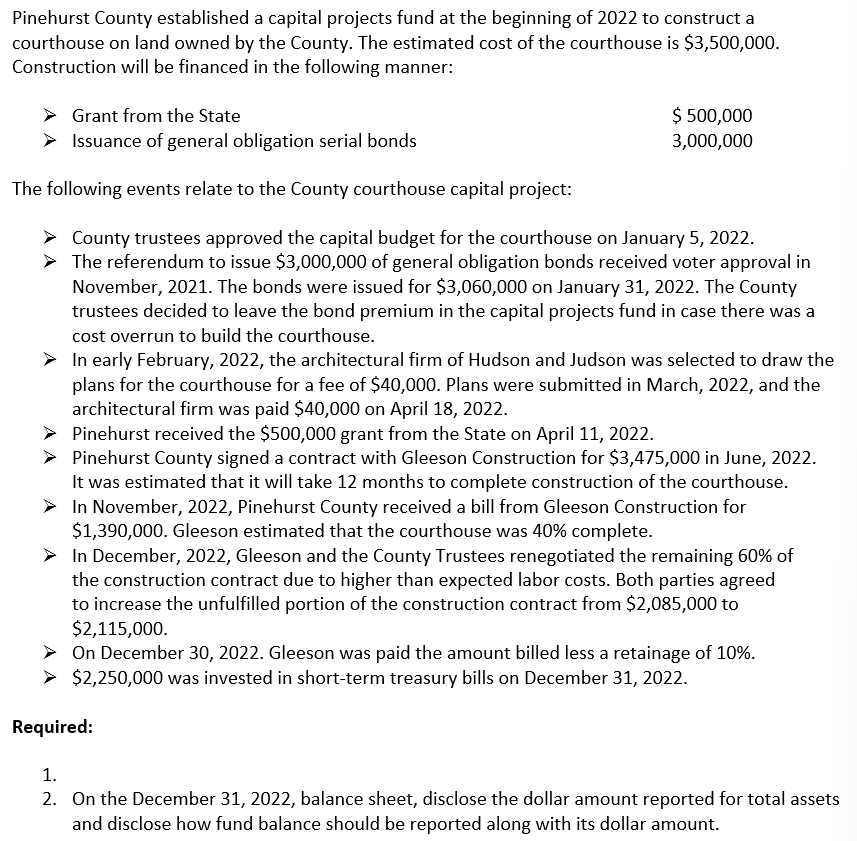

Pinehurst County established a capital projects fund at the beginning of 2022 to construct a courthouse on land owned by the County. The estimated cost of the courthouse is $3,500,000. Construction will be financed in the following manner: The following events relate to the County courthouse capital project: County trustees approved the capital budget for the courthouse on January 5, 2022. > The referendum to issue $3,000,000 of general obligation bonds received voter approval in November, 2021. The bonds were issued for $3,060,000 on January 31, 2022. The County trustees decided to leave the bond premium in the capital projects fund in case there was a cost overrun to build the courthouse. In early February, 2022, the architectural firm of Hudson and Judson was selected to draw the plans for the courthouse for a fee of $40,000. Plans were submitted in March, 2022, and the architectural firm was paid $40,000 on April 18, 2022. Pinehurst received the $500,000 grant from the State on April 11, 2022. > Pinehurst County signed a contract with Gleeson Construction for \$3,475,000 in June, 2022. It was estimated that it will take 12 months to complete construction of the courthouse. In November, 2022, Pinehurst County received a bill from Gleeson Construction for $1,390,000. Gleeson estimated that the courthouse was 40% complete. In December, 2022, Gleeson and the County Trustees renegotiated the remaining 60% of the construction contract due to higher than expected labor costs. Both parties agreed to increase the unfulfilled portion of the construction contract from $2,085,000 to $2,115,000. > On December 30, 2022. Gleeson was paid the amount billed less a retainage of 10%. >$2,250,000 was invested in short-term treasury bills on December 31, 2022. Required: 1. 2. On the December 31, 2022, balance sheet, disclose the dollar amount reported for total assets and disclose how fund balance should be reported along with its dollar amount. Part 2: Total assets $ Pinehurst County established a capital projects fund at the beginning of 2022 to construct a courthouse on land owned by the County. The estimated cost of the courthouse is $3,500,000. Construction will be financed in the following manner: The following events relate to the County courthouse capital project: County trustees approved the capital budget for the courthouse on January 5, 2022. > The referendum to issue $3,000,000 of general obligation bonds received voter approval in November, 2021. The bonds were issued for $3,060,000 on January 31, 2022. The County trustees decided to leave the bond premium in the capital projects fund in case there was a cost overrun to build the courthouse. In early February, 2022, the architectural firm of Hudson and Judson was selected to draw the plans for the courthouse for a fee of $40,000. Plans were submitted in March, 2022, and the architectural firm was paid $40,000 on April 18, 2022. Pinehurst received the $500,000 grant from the State on April 11, 2022. > Pinehurst County signed a contract with Gleeson Construction for \$3,475,000 in June, 2022. It was estimated that it will take 12 months to complete construction of the courthouse. In November, 2022, Pinehurst County received a bill from Gleeson Construction for $1,390,000. Gleeson estimated that the courthouse was 40% complete. In December, 2022, Gleeson and the County Trustees renegotiated the remaining 60% of the construction contract due to higher than expected labor costs. Both parties agreed to increase the unfulfilled portion of the construction contract from $2,085,000 to $2,115,000. > On December 30, 2022. Gleeson was paid the amount billed less a retainage of 10%. >$2,250,000 was invested in short-term treasury bills on December 31, 2022. Required: 1. 2. On the December 31, 2022, balance sheet, disclose the dollar amount reported for total assets and disclose how fund balance should be reported along with its dollar amount. Part 2: Total assets $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts