Question: ANSWER FORM BELOW: Problem 3: Comprehensive Annual Financial Report Questions Use the Comprehensive Annual Financial Report for the Village of Arlington Heights for the year

ANSWER FORM BELOW:

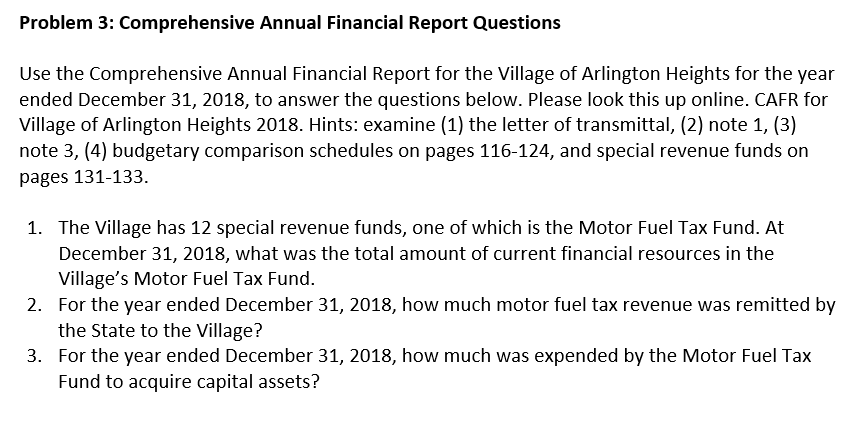

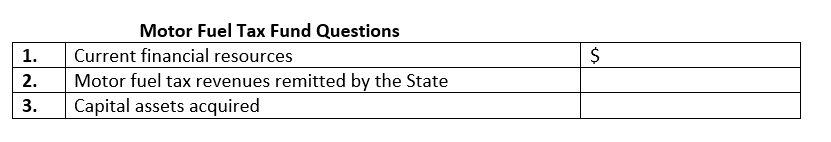

Problem 3: Comprehensive Annual Financial Report Questions Use the Comprehensive Annual Financial Report for the Village of Arlington Heights for the year ended December 31, 2018, to answer the questions below. Please look this up online. CAFR for Village of Arlington Heights 2018. Hints: examine (1) the letter of transmittal, (2) note 1, (3) note 3 , (4) budgetary comparison schedules on pages 116124, and special revenue funds on pages 131-133. 1. The Village has 12 special revenue funds, one of which is the Motor Fuel Tax Fund. At December 31, 2018, what was the total amount of current financial resources in the Village's Motor Fuel Tax Fund. 2. For the year ended December 31, 2018, how much motor fuel tax revenue was remitted by the State to the Village? 3. For the year ended December 31, 2018, how much was expended by the Motor Fuel Tax Fund to acquire capital assets? Motor Fuel Tax Fund Questions \begin{tabular}{|l|l|l|} \hline 1. & Current financial resources & $ \\ \hline 2. & Motor fuel tax revenues remitted by the State & \\ \hline 3. & Capital assets acquired & \\ \hline \end{tabular} Problem 3: Comprehensive Annual Financial Report Questions Use the Comprehensive Annual Financial Report for the Village of Arlington Heights for the year ended December 31, 2018, to answer the questions below. Please look this up online. CAFR for Village of Arlington Heights 2018. Hints: examine (1) the letter of transmittal, (2) note 1, (3) note 3 , (4) budgetary comparison schedules on pages 116124, and special revenue funds on pages 131-133. 1. The Village has 12 special revenue funds, one of which is the Motor Fuel Tax Fund. At December 31, 2018, what was the total amount of current financial resources in the Village's Motor Fuel Tax Fund. 2. For the year ended December 31, 2018, how much motor fuel tax revenue was remitted by the State to the Village? 3. For the year ended December 31, 2018, how much was expended by the Motor Fuel Tax Fund to acquire capital assets? Motor Fuel Tax Fund Questions \begin{tabular}{|l|l|l|} \hline 1. & Current financial resources & $ \\ \hline 2. & Motor fuel tax revenues remitted by the State & \\ \hline 3. & Capital assets acquired & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts