Question: ANSWER FORM EXAMPLE: Problem 5: Pension trust financial statements Hopeless Village maintains a single employer pension trust for its firefighters. The information below pertains to

ANSWER FORM

EXAMPLE:

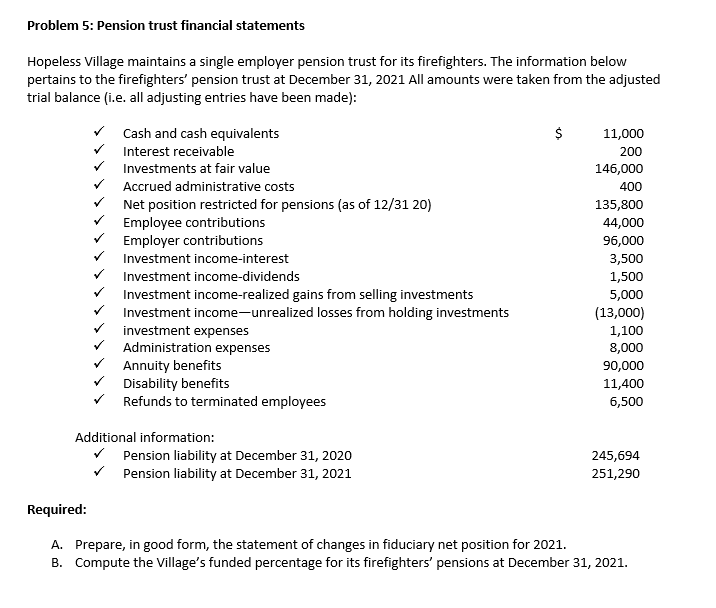

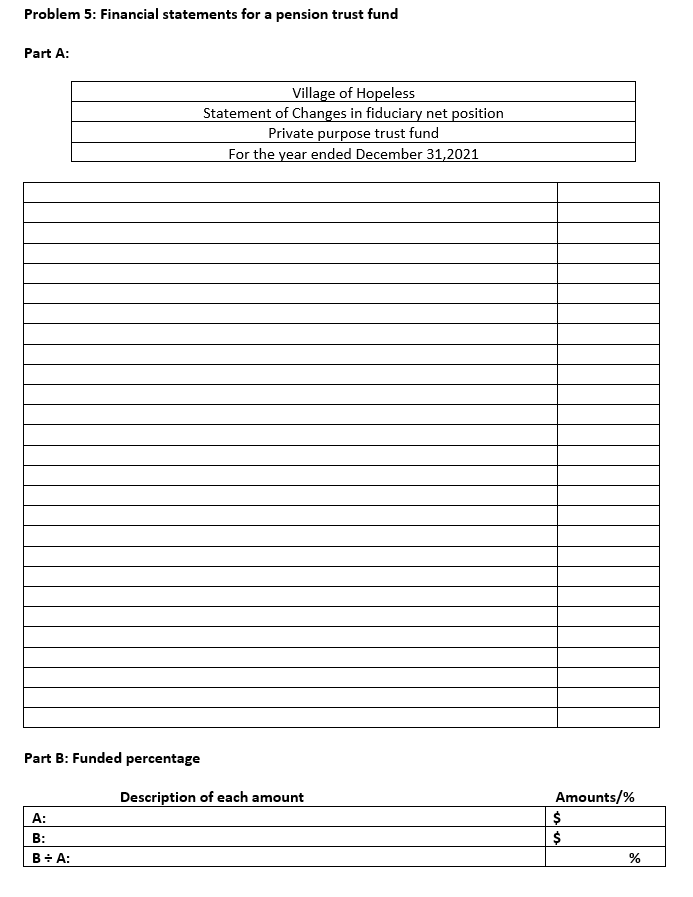

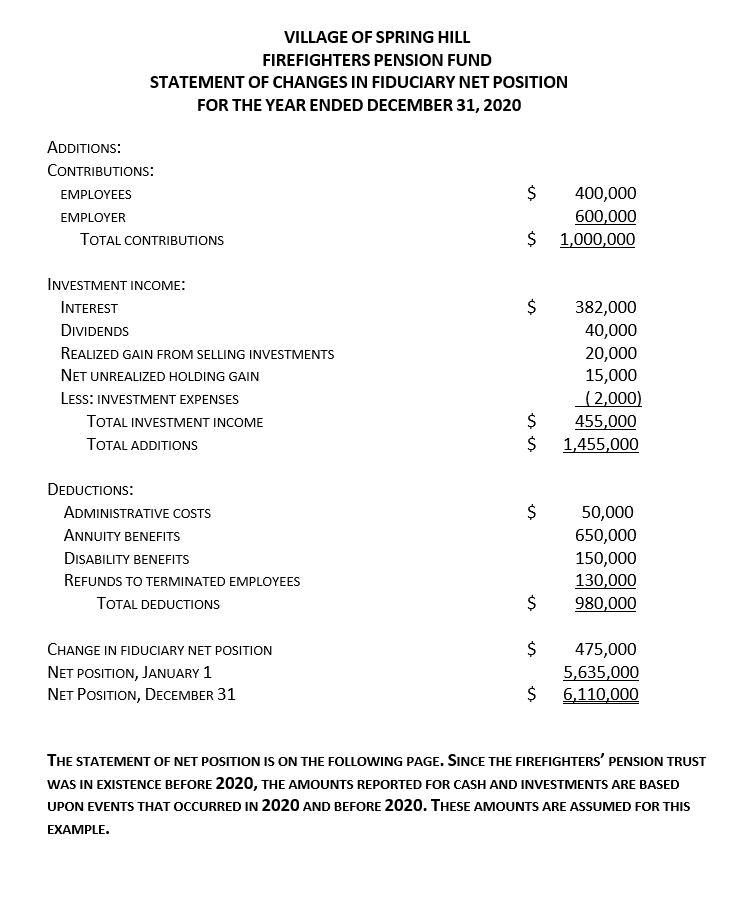

Problem 5: Pension trust financial statements Hopeless Village maintains a single employer pension trust for its firefighters. The information below pertains to the firefighters' pension trust at December 31, 2021 All amounts were taken from the adjusted trial balance (i.e. all adjusting entries have been made): $ Cash and cash equivalents Interest receivable Investments at fair value Accrued administrative costs Net position restricted for pensions (as of 12/31 20) Employee contributions Employer contributions Investment income-interest Investment income-dividends Investment income-realized gains from selling investments Investment income-unrealized losses from holding investments investment expenses Administration expenses Annuity benefits Disability benefits Refunds to terminated employees 11,000 200 146,000 400 135,800 44,000 96,000 3,500 1,500 5,000 (13,000) 1,100 8,000 90,000 11,400 6,500 Additional informat Pension liability at December 31, 2020 Pension liability at December 31, 2021 245,694 251,290 Required: A. Prepare, in good form, the statement of changes in fiduciary net position for 2021. B. Compute the Village's funded percentage for its firefighters' pensions at December 31, 2021. Problem 5: Financial statements for a pension trust fund Part A: Village of Hopeless Statement of Changes in fiduciary net position Private purpose trust fund For the year ended December 31,2021 Part B: Funded percentage Description of each amount A: B: B:A: Amounts/% $ $ % VILLAGE OF SPRING HILL FIREFIGHTERS PENSION FUND STATEMENT OF CHANGES IN FIDUCIARY NET POSITION FOR THE YEAR ENDED DECEMBER 31, 2020 ADDITIONS: CONTRIBUTIONS: EMPLOYEES EMPLOYER TOTAL CONTRIBUTIONS $ 400,000 600,000 $ 1,000,000 $ INVESTMENT INCOME: INTEREST DIVIDENDS REALIZED GAIN FROM SELLING INVESTMENTS NET UNREALIZED HOLDING GAIN LESS: INVESTMENT EXPENSES TOTAL INVESTMENT INCOME TOTAL ADDITIONS 382,000 40,000 20,000 15,000 (2,000) 455,000 1,455,000 $ $ $ DEDUCTIONS: ADMINISTRATIVE COSTS ANNUITY BENEFITS DISABILITY BENEFITS REFUNDS TO TERMINATED EMPLOYEES TOTAL DEDUCTIONS 50,000 650,000 150,000 130,000 980,000 $ CHANGE IN FIDUCIARY NET POSITION NET POSITION, JANUARY 1 NET POSITION, DECEMBER 31 $ 475,000 5,635,000 $ 6,110,000 THE STATEMENT OF NET POSITION IS ON THE FOLLOWING PAGE. SINCE THE FIREFIGHTERS' PENSION TRUST WAS IN EXISTENCE BEFORE 2020, THE AMOUNTS REPORTED FOR CASH AND INVESTMENTS ARE BASED UPON EVENTS THAT OCCURRED IN 2020 AND BEFORE 2020. THESE AMOUNTS ARE ASSUMED FOR THIS EXAMPLE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts