Question: Answer fully please 48. When monies are transferred from the General Fund to the Capital Projects Fund: A. The General Fund debits Other Financing Sources.

Answer fully please

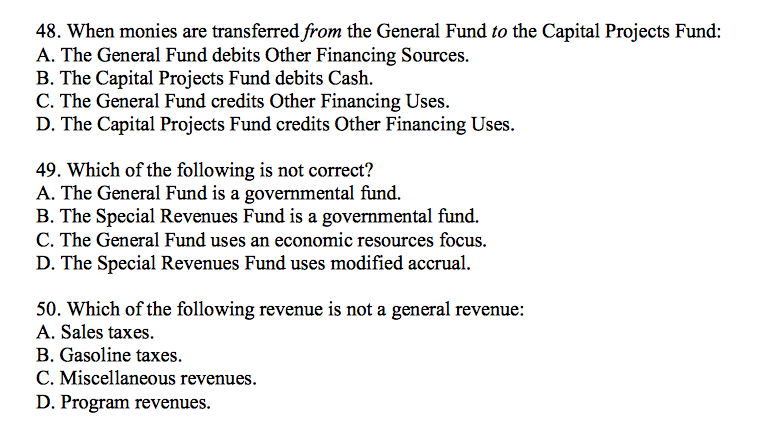

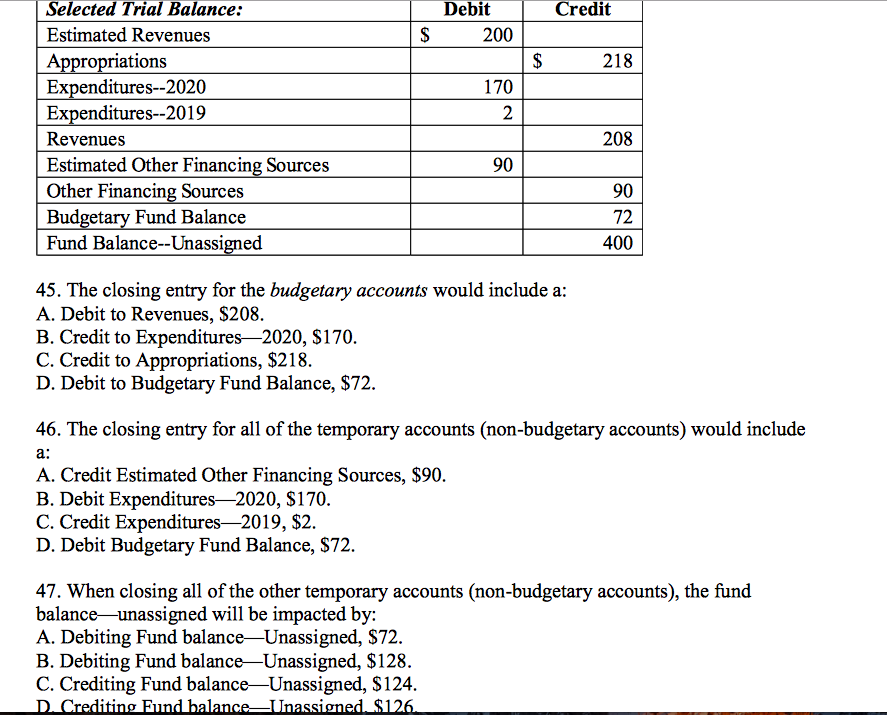

48. When monies are transferred from the General Fund to the Capital Projects Fund: A. The General Fund debits Other Financing Sources. B. The Capital Projects Fund debits Cash. C. The General Fund credits Other Financing Uses. D. The Capital Projects Fund credits Other Financing Uses. 49. Which of the following is not correct? A. The General Fund is a governmental fund. B. The Special Revenues Fund is a govemmental fund. C. The General Fund uses an economic resources focus. D. The Special Revenues Fund uses modied accrual. 50. Which of the following revenue is not a general revenue: A. Sales taxes. B. Gasoline taxes. C. Miscellaneous revenues. D. Program revenues. Estimated Revenues Arum! 'tions 218 Exenditures-2020 EXaendituresuZOlQ _ 208 _-:lil __ 90 __ 72 \"_ 400 45. The closing entry for the budgetary accounts would include a: A. Debit to Revenues, $208. B. Credit to Expenditures2020, $170. C. Credit to Appropriations, $218. D. Debit to Budgetary Fund Balance, $112. 46. The closing entry for all of the temporary accounts (non-budgetary accounts) would include a: A. Credit Estimated Other Financing Sources, $90. B. Debit Expenditures2020, $120. C. Credit Expendittn'esZDIP, $2. D. Debit Budgetary Fund Balance, $72. 47. When closing all of the other temporary accounts (non-budgetary accounts), the fund balanceunassigned will be impacted by: A. Debiting Fund balanceUnassigned, $72. B. Debiting Fund balanceUnassigned, $123. C. Crediting Fund balanceUnassigned, $124. 13:1"E111 II . 15125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts