Question: Answer g and h. The picture should be able to be seen on a desktop computer. Show all work. Thanks. (20pts) Consider a two-date binomial

Answer g and h. The picture should be able to be seen on a desktop computer. Show all work. Thanks.

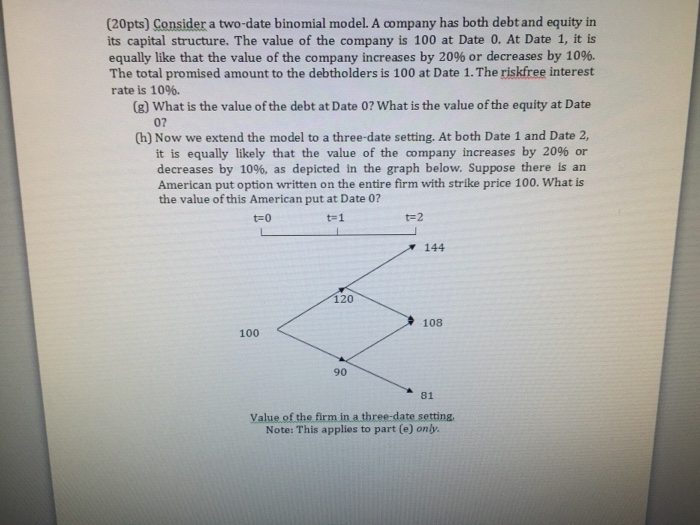

Answer g and h. The picture should be able to be seen on a desktop computer. Show all work. Thanks.(20pts) Consider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1.The riskfree interest rate is 10%. (g) What is the value of the debt at Date 0? What is the value ofthe equity at Date 0? (h) Now we extend the model to a three-date setting. At both Date 1 and Date 2, it is equally likely that the value of the company increases by 20% or decreases by 10%, as depicted in the graph below. Suppose there is an American put option written on the entire firm with strike price 100. What is of this American put at Date 0? t-0 t-1 144 120 108 100 90 81 Value of the firm in a three-date setting. Note: This applies to part (e) only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts