Question: Problem 5-47 Amortizing Loans and Inflation (LO3) Suppose you take out a $108,000, 20-year mortgage loan to buy a condo. The interest rate on

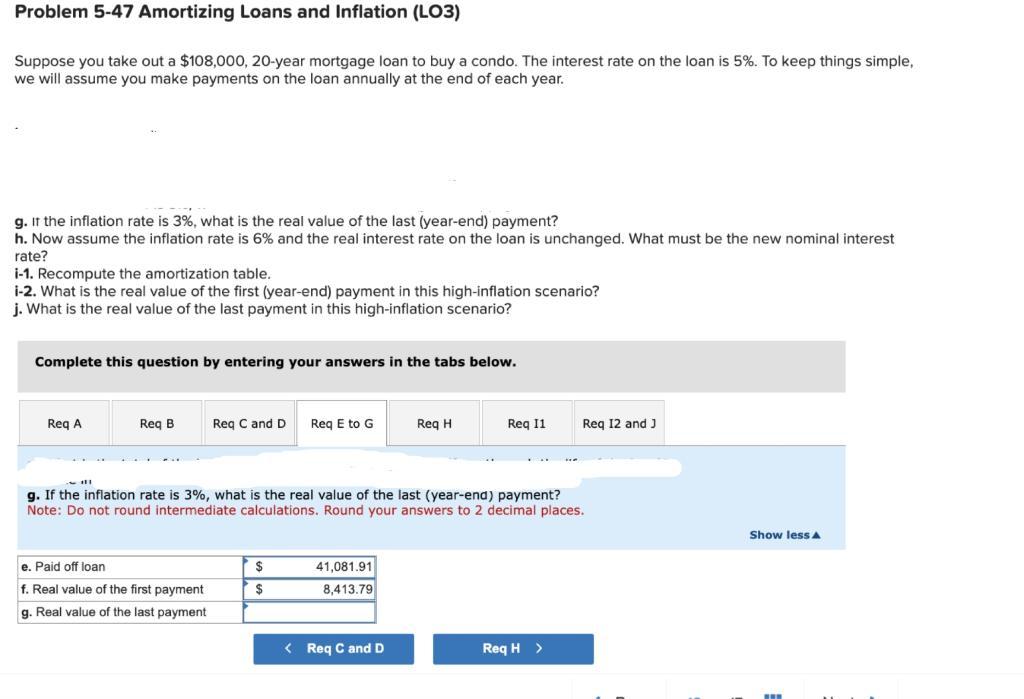

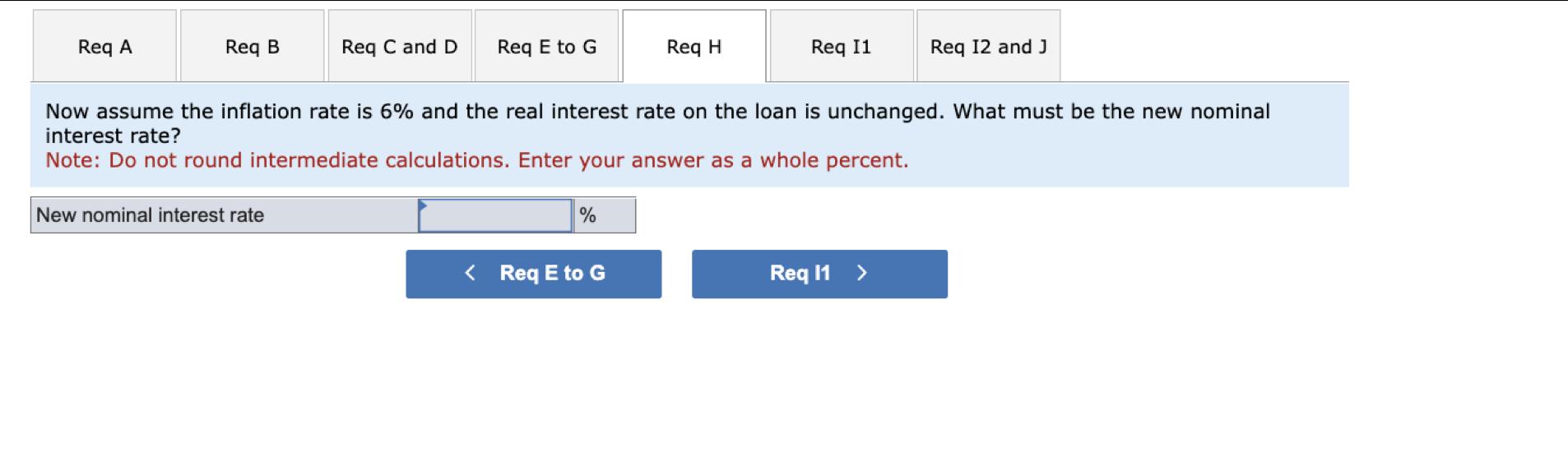

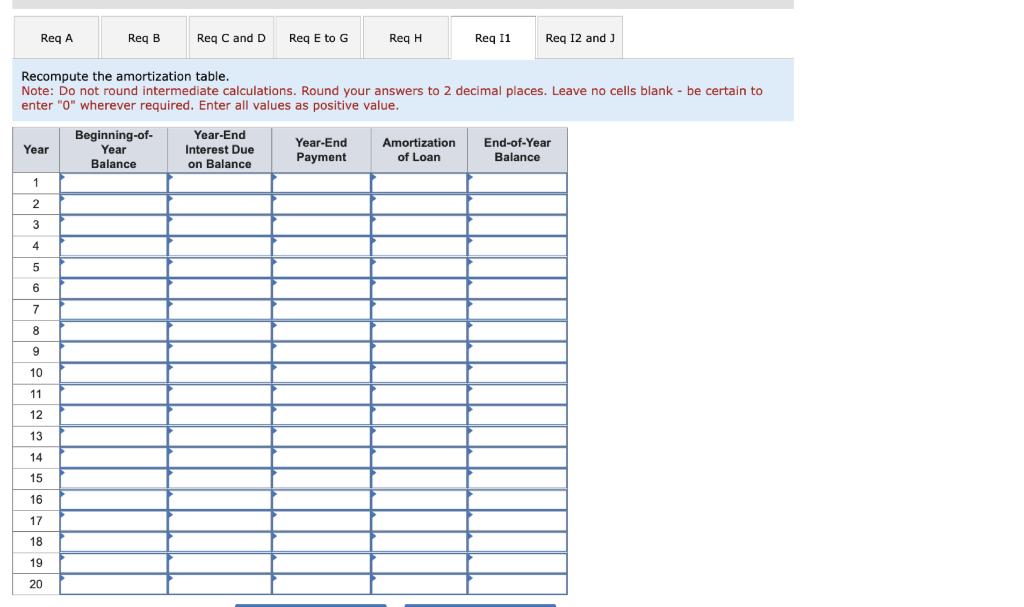

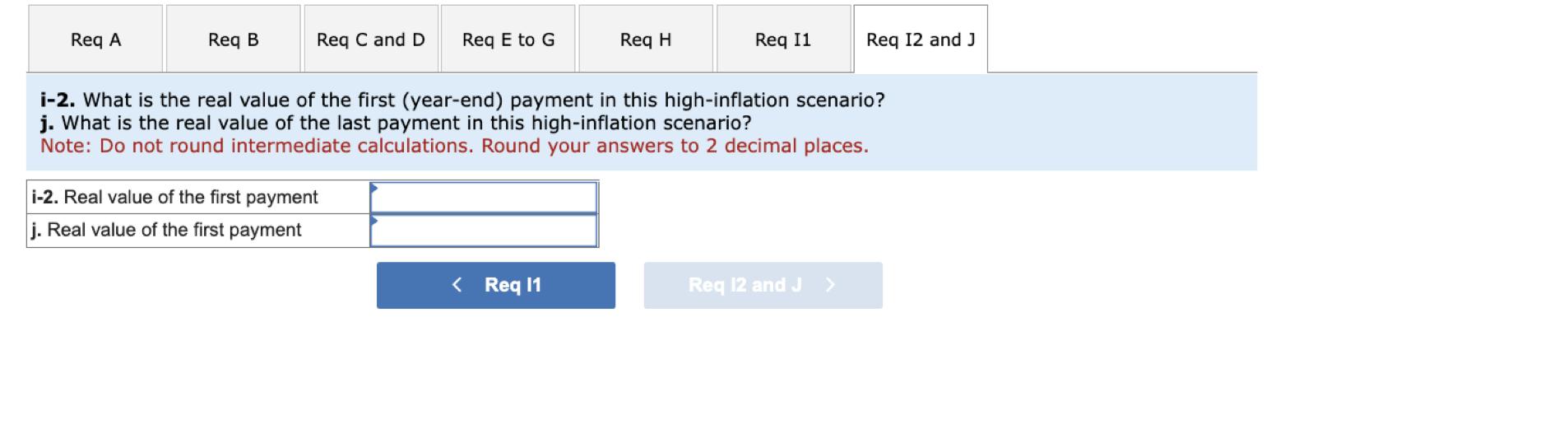

Problem 5-47 Amortizing Loans and Inflation (LO3) Suppose you take out a $108,000, 20-year mortgage loan to buy a condo. The interest rate on the loan is 5%. To keep things simple, we will assume you make payments on the loan annually at the end of each year. g. It the inflation rate is 3%, what is the real value of the last (year-end) payment? h. Now assume the inflation rate is 6% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? i-1. Recompute the amortization table. i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Complete this question by entering your answers in the tabs below. Req A Req B Req C and D e. Paid off loan f. Real value of the first payment g. Real value of the last payment Req E to G $ $ 41,081.91 8,413.79 Req H ~111 g. If the inflation rate is 3%, what is the real value of the last (year-end) payment? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. < Req C and D Req 11 He Req H > Req 12 and J Show less A Req A Req B Req C and D New nominal interest rate Req E to G % Req H Now assume the inflation rate is 6% and the real interest rate on the loan is unchanged. What must be the new nominal interest rate? Note: Do not round intermediate calculations. Enter your answer as a whole percent. < Req E to G Req I1 Req 12 and J Req 11 > Req A Year 1 2 3 4 5 6 7 8 9 10 11 12 Req B 13 14 15 16 17 18 19 20 Recompute the amortization table. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required. Enter all values as positive value. Req C and D Req E to G Beginning-of- Year Balance Year-End Interest Due on Balance Req Hi Year-End Payment Req 11 Amortization of Loan Req 12 and J End-of-Year Balance Req A Req B Req C and D Req E to G i-2. Real value of the first payment j. Real value of the first payment Req H < Req 11 Req I1 i-2. What is the real value of the first (year-end) payment in this high-inflation scenario? j. What is the real value of the last payment in this high-inflation scenario? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Req 12 and J Req 12 and J >

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Part g Real value of last payment with 3 inflation Last payment amount is given in the question as t... View full answer

Get step-by-step solutions from verified subject matter experts